Lower Your Mortgage Rate. Build Your Wealth. Retire Sooner.

See how we can plan your mortgage to help you save and grow up to 10x faster

Brent Richardson

Principal Mortgage Broker/ Owner, Certified Financial Planner (CFP®)

- Considered a Canadian mortgage thought leader: Get personalized pre-approval information and quotes for exclusive low mortgage rates – no fees, no hard credit check, no obligation. All application types are welcome.

- Over 16 years of industry experience with 1800+ mortgages personally approved: Get a fast 1 day approval, increase your approval limit, or lower your payment and rate. Get more options and better approval results.

- Certified Financial Planner (CFP®) credential: Complimentary advice to save on taxes, optimize wealth creation, become mortgage free and retire sooner.

- We’re determined to lower your rate and help make your approval a breeze: Clients save $1,000+ per year on average, or $25,000+ on average over the life of a mortgage.

Level Up Your Mortgage Game With a Certified Financial Planner (CFP®)

Home ownership and the mortgage may be the biggest part of your financial picture, and can play a major role in helping you reach your financial goals. Get advice to reduce interest costs, save on taxes and build wealth faster. Keeping your mortgage approval in focus, we can discuss the following at your option:

Mortgage/Debt Planning

How do I safely balance a great lifestyle and home ownership costs? Do I repay my mortgage faster, or save more for retirement? Will I have enough saved for retirement after my mortgage is paid off? Am I taking advantage of mortgage related income tax savings strategies? Get answers to such questions that apply to your unique situation, and ensure the best interest rate savings, consistently over the life of your mortgage.

Income Tax Reduction

Reducing income taxes substantially is possible for many, but requires longer term planning. Discussions can include making mortgage interest tax deductible, income splitting, pension/benefit optimization, RRSP, TFSA and other income tax savings strategies.

Wealth Accumulation

Optimizing wealth building strategies, even slightly, can have a major compounding effect over time. Conversations can include portfolio reviews and how to build wealth more effectively with ultra low investment management costs (under 0.20% Vs. the standard 2%). Discover some of the most simple but profitable investment strategies that the investment industry doesn't want you to know.

Retirement Planning

Get answers to your retirement questions including: How soon can I retire? How much savings will I need to retire? How much will I have to spend each month from various income streams? Our advice only financial planning approach provides objective, unbiased answers to such questions.

Estate Planning

The are few certain things in life, except for death and taxes. The government already has an estate plan for you, but you probably won't like it... Speak for your assets, save on taxes, and probate fees. Conversations may include purchasing a property tenancy in common vs joint tenancy, what to add or remove from a will or power of attorney, if a trust makes sense and more.

Protection Planning

Setbacks in life are inevitable. We hope the setbacks won’t be too big. But no matter what happens a good plan will have you covered.

Daily Coverage of the Canadian Mortgage Market

>> Click to follow on X (Twitter), YouTube, and Instagram for advice, market updates and answers to your questions <<

Fears of a credit crisis and geo political risk gave way to anticipation of higher inflation due to a spike in oil prices Monday morning

Accordingly, Bond yields lept ~3.5%

A sustained war of 2-3 weeks+ could result in an inflationary trend and upward fixed rate pressure

We are seeing some of the lowest fixed mortgage rates in over 3 years:

5 YR fixed @ 3.69% for purchases and 3.79% for renewals

VRM still carries upside risk, but the outlook is improving

BoC odds have pulled back from 4 hikes (1%) over the next 5 years to 3 hikes (0.75%)

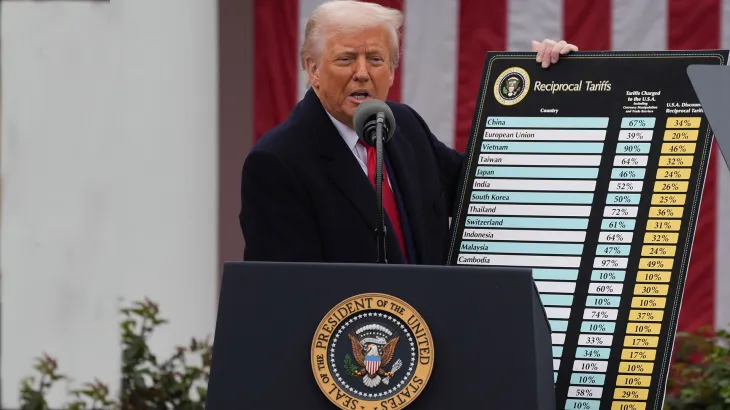

And bond yields barely flinched on the news… among all the tariff noise, the bond market has remained cool as a cucumber

BREAKING: The Supreme Court of the United States has officially ruled that President Trump's tariffs are illegal, in a 6-3 ruling.

The US now faces $150+ billion in potential tariff refunds.

🇨🇦 CPI/ inflation in January lowered by 0.1% to 2.3%, slightly under consensus of 2.4%. Excluding gasoline, inflation was 3%

This, plus investors moving to safety in bonds/lower yields prompted some banks to reduce fixed rates by ~0.05%

Odds of a BoC March cut increased to ...13%

$PYPL plan to buy back $6B of shares in 2026 could be a terrible strategy if the business decelerates

Until growth stabilizes, management should allocate capital to growing assets - even treasuries

Otherwise its just more good money after bad

Check out the latest edition of my newsletter

It discusses the Canadian jobs market and market volatility in software, AI, Bitcoin, Gold and Silver

Canadian Economic, AI, SaaS, Crypto, Gold and Silver Update

www.richreport.caThe 🇨🇦 jobs market in Jan moved in several directions at once:

• Unemployment📉to 6.5% due to exits from the workforce

• Full time:📈by 45,000

• Part time:📉70,000, netting 25,000 lost jobs

Financial markets ultimately shrugged it off; mortgage ...rates remain stable

The Ontario and Federal governments have invested $ hundreds of millions into this plant, with earmarked subsidies of up to $15 Billion

Stellantis just sold its stake for $100

Automaker Stellantis is selling its 49 per cent stake in an Ontario battery plant to its joint venture partner LG Energy Solution for a nominal...

ca.finance.yahoo.comServing the Best Mortgage Rates in Ontario

We’re Ontario mortgage brokers serving clients the best mortgage rates in Ontario. We use encryption and high-level security to ensure your information and privacy always remain safe. Our approval process has been engineered from start to finish with you in mind, for a pleasant and enriching mortgage experience. Connect with us today and see the difference for yourself.