Mortgage Rate Forecast Canada 2025 – 2028

The next Bank of Canada interest rate announcement is on:

July 30, 2025

**Follow on X(Twitter) HERE for daily interest rate news and updates**

The decisions Canadians make on their mortgage in 2025 largely depend on the mortgage rate forecast. It’s a decision that will affect homeowners for several years to come and could lead to thousands of dollars in mortgage interest savings.

Here, we will look at where mortgage rates are likely headed based on a current review of economics, years of in-depth mortgage market study, and working with thousands of mortgage files.

This page is updated weekly based on current economic data. Bookmark and revisit to see how the conversation evolves based on changes in the market.

- Historical context: While historical influences on mortgage interest rates are significant, global economics are changing rapidly, which will lead to higher average interest rates than we’ve seen over the past 15 years.

- Short Term Mortgage Rate Forecast: On July 30, there is an 80% chance the Bank of Canada will hold its overnight rate at 2.75%.

- Longer Term Mortgage Rate Forecast: 2025 – 2026 Mortgage Rate Trend: The Bank of Canada is projected to cut its overnight rate by 0.25% and hold.

- How to position yourself with the best mortgage rate in 2025 to save the most on your mortgage.

Historical Context: While historical influences on mortgage interest rates are significant, we’ll see higher average interest rates than we’ve seen over the past 15 years.

To help determine the future of mortgage rates, the best perspective we have is a historical one. However, the economic changes we’re currently witnessing on a US and global level will significantly alter the course of interest rates.

The interest rate environment going forward will, therefore, be a fusion of historical economic forces and current forces. Accordingly, we will likely experience higher long term interest rates than the 2% range enjoyed for the 11 years between the 2008 ‘great recession’ and the onset of COVID 19. However, while we may not see those ultra low mortgage rates, rates will remain under a downward pressure, likely holding below 5%.

Interest rates 2008 – 2019

During the great recession of 2008, the financial system and economy as a whole required bailouts and stimulus as never before seen just to keep running. Thankfully, the stimulus did its job, and the economy rebounded and got back on track. However, between 2008 – 2019, for over 11 years, there was very low or stagnant GDP/ economic growth and interest rates remained low accordingly.

But sluggish GDP growth wasn’t the only reason for low interest rates. It’s important to understand the other significant economic factors at play over this period:

- Free trade relationships supported lower cost production of everyday goods in other countries.

- Very low inflation or even deflation as a result of this free trade.

- A stronger US (and Canadian) dollar was the indisputable safe haven in the global economy and by far the benchmark for the most stable and trusted place to hold reserve currency (ie. safe place for other countries to hold their money).

As we will review soon, there have been considerable changes in almost every aspect mentioned above.

Interest rates 2020 – 2022

During the COVID pandemic, in 2020 – 2022, we witnessed a similar massive economic bailout to the 2008 financial crisis. This time, the stimulus was far greater, with over 40% of dollars ever created between 2020 – 2022.

This expansion of debt currency in Canada had profound effects on future interest rate flexibility and decision making.

Fundamentally, when a massive new government and private debt are layered upon already massive debt, this can perpetuate dependence on yet ever cheaper debt to stimulate the economy long term. High debts can lead to long term economic stagnation and, importantly, to a ‘magnified effect’ of interest rates.

Specifically, with 6 times more debt in the economy today, adjusted to inflation, than in the 1980s and early 90s, interest costs have approximately 6 times more effect on the economy.

So, when interest rates are even slightly restrictive it can have a significantly negative impact on the Canadian economy.

We saw proof of this in 2023 – 2024, as the Central Bank of Canada rates at 5% (lowest mortgage rates around 6%) materially slowed the Canadian economy. If mortgage rates had remained in the 6% range, the Canadian economy would likely be in a major recession today.

As the economy takes on more debt as a whole, the need for lower rates to sustain economic growth only increases, and this is a fundamental, foundational economic principle we need to keep in mind.

However, pre-COVID policy changes in 2017 had already initiated the shift away from these historically low mortgage interest rates.

Interest rates 2022 – Today

The global economic structure began to change away from the lower cost benefits of free trade and globalization to the higher cost, inflationary policy of protectionism and re-shoring of production.

The idea in its most simple form is, while there is the benefit of re-shoring or ‘re patriating’ lower skilled production work for higher pay – this translates to higher costs, which is inflation.

The initial effects of these policies were not felt as much during those first 2 years before COVID. However, as COVID-19 took its toll and the global supply chain attempted to re-establish and re-integrate itself, the issues of deglobalization became more apparent. This made it easy for inflation to skyrocket, peaking at 8.1% in Canada in 2022.

The higher debt levels, as noted previously, mean that 5% Bank of Canada overnight interest rates (and 6%+ mortgage rates) were enough to repress this high inflation. However, as rates attempt to find their footing in 2025, it is becoming apparent that, given a continuation of protectionist economic policy, the economy is far more sensitive to inflation.

Fundamentally, we are witnessing a major shift in the US trade policy from the time of 2008-2017, to the extent that this period is no longer comparable to today’s economic situation. In fact, today, the tariff based protectionism and de-globalization movement is only gaining momentum, and moving away from the low cost, low inflation and ultra low rate era.

Counter Arguments?

Some economists will point to a weaker economy in Canada and globally as a reason for lower consumer spending and, therefore, lower inflation. Indeed, low (or negative) economic/GDP growth, combined with low inflation, should promote the kinds of historically low 2% range mortgage rates that we saw in the 2008 – 2020 timeframe.

However, when looking at Canada specifically, there are several counter points to this that would lead to higher inflation and higher interest rates in the long term:

- Weaker Canadian dollar: This means anything we import from any country is more expensive. This is not exclusive to imports from the US. Every country’s currency is relative to the Canadian dollar, and they sell goods in their own currency. If the Canadian dollar is weaker, it means it requires more dollars to purchase their products. This is called ‘import inflation’. It doesn’t matter if we import more or less of these goods, with a weaker Canadian dollar, the cost is higher.

- Downgrading of Canadian Debt: If Canada is in such a weak economic position, relative to the US and other countries, that we need to cut the Bank of Canada policy interest interest rate down to the 1% range, it probably means Canada is seen as a relatively riskier place to invest and do business. This means the default risk of holding Canadian bonds and other debt has increased. So given higher default risk, Canada must offer higher interest rates on its debt to continue selling it. This promotes a vicious cycle in that Canada needs to pay even more interest on its more expensive debt, which requires even more debt/ government deficit to fund the interest costs. This can lead to higher risk and further debt ‘re ratings’ or downgrades.

- Counter Tariffs: Are considered by the Bank of Canada as a ‘one-time bump in prices’. For example, if the government of Canada places a 25% tariff on Florida oranges, this bumps up the price of Florida orange juice by 25%. But only once. So counter tariffs, as a ‘one time event’ are not as systemic (not as bad) as the above reasons, but will nevertheless be inflationary.

It’s possible that Canada will create new free trade relationships in Europe, Asia, and other regions to help mitigate the current changes in US economic policy. It’s also possible the US will lessen its tariffs and protectionist strategy. These would undoubtedly ease inflation, but only to a degree.

However, these changes for Canada could take years, and for purposes here of forecasting mortgage rates, we are looking out to the next 1-5 years. Once the process is started, it takes years to change. Think of any economic direction as a slow moving ship. It takes a while to turn in either direction, and once heading in a new direction, it takes time to turn back.

So overall, we will see a mix of the historical need for low interest rates to fuel Canada’s current government (and to a lesser extent private) debt dependency and mitigate economic weakness. However, this historical context will be significantly skewed by the changing economic order of tariff protectionism and de-globalization.

Accordingly, we will likely see neutral rates or baseline rates over the medium-long term of 3-7 years settle 1%-2% higher Central Bank overnight interest rates than witnessed in the period from 2008 to 2020. More specifically, instead of 2%-3% mortgage interest rates as a long term floor, we are likely to see 3%-5% interest rates over the medium-long term, which is factoring in a weaker Canadian economy.

For those with mortgages, the key will be attempting to time the dips in interest rates and take advantage of lower mortgage rate lock-ins if these opportunities present themselves. As of June 2025, at a time of initial tariffs, we are monitoring closely for one such opportunity, and with rates in the 3% range, we may be close.

We’ll also discuss the current economic trends in more detail and how they affect mortgage interest rates.

Want expert mortgage advice and the best rates?

**Follow me on Twitter HERE for regular interest rate and mortgage rate updates**

Short Term Mortgage Rate Forecast Canada: Bank of Canada Next Announcement

As of July 11, the market consensus on the mortgage rate forecast in Canada is for the Central Bank to hold its overnight rate at 2.75% at its July 30 meeting.

The main tool we have when reading the current mortgage rate market is the Government of Canada Bond Yield. The Canadian bond is a government debt security that pays a return to an investor. The ‘%’ based return to the investor is called the ‘yield’ and is considered one of the safest investments because the Government would have to go bankrupt for it not to pay its investors.

The Government of Canada 5-year Bond Yield factors in all known economic data on a day to day, and even a minute to minute basis. Simply put, when the market/ bond traders think that the Central Bank of Canada will increase rates, the Bond Yield increases. When the Bond market thinks the Central Bank rate will decrease, then the yield drops. In other words, the Bond yield trades or is priced in anticipation of where the Central Bank of Canada rates will move. The Central Bank of Canada makes its rate decisions based on how it sees the economy performing.

Currently, as of July 11, 2025, as seen in the Yield chart below, the Canadian Bonds are pricing in:

- 20% chance for a 0.25% Bank of Canada rate cut on July 30 (80% chance of a hold)

Or if no cut, then:

- 50%+ chance for a 0.25% Bank of Canada rate cut in December

Given the following economic key data, it appears that the economy is cooling, however remaining resilient in the face of trade and other issues facing Canada, leading to fewer rate cuts than expected earlier in 2025 :

May (Q1) 2025 GDP/ economic growth:

GDP released in May beat expectations (2.2% vs 1.7% exp.), however this higher growth was primarily due to ‘tariff front running’, which means companies did more business before tariffs added higher costs. As this effect dissipates over the Spring/ Summer, GDP growth is likely to cool.

June 2025 Labour/jobs market:

In a surprise release, unemployment was down 0.1%, to 6.9% as the Canadian economy added 89,000 new jobs.

June 2025 CPI/ Inflation:

1.7%, which is unchanged from May. Inflation remains low, however price increases due to tariffs can take months to pull through, and this is a concern in the financial markets.

Discussion: Tariff Wars: Higher or Lower Mortgage Rates?

The effects of US tariffs and Canadian counter-tariffs are front and centre and will have a major impact on determining the interest rate path for Canada.

In fact, the Bank of Canada, at its meeting in March 2025, stated that it was primarily because of tariffs and economic uncertainty that it cut by 0.25%. Otherwise, they would have left the interest rate unchanged.

This means that the uncertainty caused by tariffs is already leading the Bank of Canada’s policy.

Accordingly, the short term net effect of higher tariffs would likely be lower rates.

The likely scenario is that the lower the rate in the short term (ie 2025), the higher inflation can be in the long term (ie 2026 and beyond). As discussed previously, this is due to higher costs of importing goods and effects of counter tariffs. Even with a weak economy and slow consumption, the higher price of goods would pull through to the consumer – regardless of the interest rate. The result would be an unfortunate ‘stagflationary’ environment.

Indeed, according to the Bank of Canada, lower interest rates help to ‘ease the short term transition into a tariff laden economy’. However, lower Bank of Canada rates are not the solution to high tariffs and to the economic damage they would cause. If inflation crept back up, for example, later in 2025 or in 2026, the Central Bank’s hand would be forced to increase no matter how sluggish the economy.

A US/Canadian Recession Scenario for Interest Rates

If the US dipped into recession, this would undoubtedly bring the Canadian economy with it. While the US economy is currently stable, the uncertainty in the market is at all time highs and if tariffs are not reduced over the coming weeks and months, the threat of recession becomes significant.

A US recession is currently a lower probability. However, if this were to happen, we could see lower interest rates. A more inflationary environment would limit how much interest rates would be cut by, but an additional cut of 1% in the US and Canada is certainly possible. This is not the base case, but we are monitoring for changes.

*1 Month Bond Yield View*

*1 Year Bond Yield View*

Long Term Mortgage Rate Predictions: 2025 – 2028 Cut by 0.25%

0.25% additional Interest Rate Cuts in 2025 are currently priced into bond yields and broader financial markets. This would bring the Bank of Canada Overnight rate from 2.75% currently to 2.50% and the Commercial Bank Prime Rate down to 4.7%

Financial Market prediction for interest rates:

As of July 2025, the Bank of Canada prime rate/ overnight lending rate is 2.75% and financial markets are forecasting:

| Date | Current Bank of Canada Rate Forecast |

|---|---|

| July 2025 | 2.75% |

| September 2025 | 2.75% |

| October 2025 | 2.75% |

| December 2025 | 2.50% |

| January 2026 | 2.50% |

| March 2026 | 2.50% |

Fixed and Variable Mortgage Rate Forecast in 2025

| Date | 5 YR Fixed Mortgage Rate Forecast | Variable Mortgage Rate Forecast (Prime – 0.75%) |

|---|---|---|

| July 2025 | 3.89% | 4.20% |

| September 2025 | 3.99% | 4.20% |

| October 2025 | 4.09% | 4.20% |

| December 2025 | 4.09% | 3.95% |

| January 2026 | 4.09% | 3.95% |

| March 2026 | 4.09% | 3.95% |

As of July 2025, here are the Big Bank predictions for mortgage rates in Canada:

| Bank | June Decision | Summer 2025 | Fall 2025 | Winter 2025 |

|---|---|---|---|---|

| TD | 2.50% | 2.50% | 2.25% | 2.25% |

| RBC | 2.75% | 2.75% | 2.75% | 2.75% |

| Scotia | 2.75% | 2.75% | 2.75% | 2.75% |

| CIBC | 2.75% | 2.25% | 2.25% | 2.25% |

| BMO | 2.75% | 2.50% | 2.25% | 2% |

| National | 2.75% | 2.25% | 2.25% | 2% |

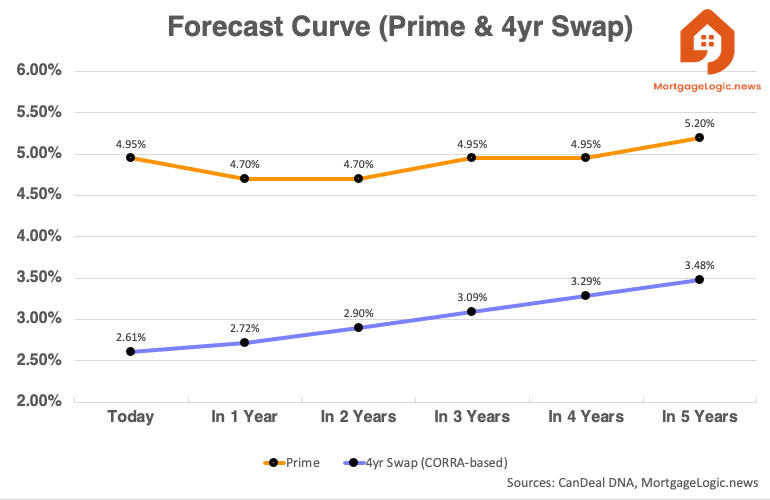

Courtesy of our friends at MortgageLogic.News here are the long term mortgage rate predictions according to financial markets:

How to position yourself with the best mortgage rate in 2025 to save the most on your mortgage

A lot has changed over the past 12 months interest rate wise. While from 2022-2024, we strongly encouraged a shorter term fixed rate or variable rate, we now see the 5-year fixed as the best risk/reward value for the majority of Canadians. Or the variable rate for those who are more financially secure and comfortable with additional risk and ‘potential for lower rates’ (reward) proposition.

In other words, unlike in 2022-2024 when mortgage rates were definitively restrictive in the 5% – 6% range, and there was clearly more downward pressure on rates, today we see real potential for rates will be higher in 3 years. This reasoning is aligned with current financial market data as noted above.

5 Year Fixed Mortgage Rate

For most Canadians, a 5-year fixed rate under 4% makes a lot of sense. Some will be luckier to ‘lock in’ closer to the mid 3% range. There’s also potential for the low 3% range in a dire economic situation. But when we’re looking at an ~0.25% rate difference, it’s very difficult to time the bottom perfectly, and 0.25% doesn’t look as bad in the bigger picture context of rates potentially increasing by 1% in the future. Moreover, there are differences in rates between fully CMHC insured mortgages and conventional mortgages with 20% down payment, with the latter carrying a slight rate premium.

This isn’t to say that the variable rate is off the table

The variable is a higher risk, higher reward proposition. More specifically, the variable rate could potentially fall another 1%+, and hold there for longer, given the right mix of economic recession in the US and Canada. But everything discussed here is a matter of likelihood and probability, and based on this way of thinking, the variable rate has limited downward movement.

Importantly, the variable rate includes a fixed rate lock in feature. So there is a strategy for monitoring rates for further downward movement and then to lock in. At Altrua, we work with variable rate holders to help monitor rates and keep in contact for lock in opportunities.

It’s also important to note that at the time of writing, fixed rates are lower than variable rates, and the bond yields that price fixed rates, are expecting another 0.50% of Bank of Canada rate decreases. So we would need to see the markets expecting another 0.75%+ of central bank rate decreases for variable to notably outperform fixed. This is possible, but it would likely require more significant long term economic damage and a US recession to facilitate. So this is what the variable mortgage rate holder would be betting on.

This is less likely, and the financial markets are not currently pricing it in. But it is possible.

What about the 3 year fixed mortgage rate?

There was a time in 2022 when rates close to 6% clearly spelled a slower economy and, therefore, an opportunity for a drop.

At that time, in 2022, it was hard to lock in a 1-2 year rate in the mid-high 6% range. It was also hard to lock in a 5-year fixed rate in the high 5% low 6% range. So, the 3 year fixed, priced just slightly higher than 5 year fixed, made a lot of sense.

This idea of locking into a 3 year rate really caught on and carries momentum today. I know because I was one of the market commentators advising on this before it was popular.

However, today, there is as much, if not more risk that rates will be higher in 3 years than lower. If you’re betting on a renewal in 3 years at a lower rate, you are betting against the financial market. This isn’t to say with absolute certainty that rates won’t be lower in 3 years. It’s possible. It’s just higher risk. It’s not the same as in 2022 – early 2024.

Or you could potentially break the 3 year for example, 1.5 years into the term, and get a lower rate if it’s there. Due to the penalty, rates would likely have to be significantly lower. This would likely require a structural economic policy change, which, although possible, is unlikely. It’s more likely for there to be a policy change after 4 years are up.

For those seeking more reward for the risk, we see variable as a better, more flexible bet than a 3 year fixed. However, a 5-year fixed under 4% is the better risk-adverse fit based on everything discussed here.

Thanks for reading. Connect with me, Brent Richardson, article author and Mortgage Broker/ Owner of Altrua Financial, today to discuss your best mortgage rate and strategy.

Major Bank Prime Interest Rates Canada

4.95%

4.95%

4.95%

4.95%

4.95%

Central Bank of Canada Prime Rate