The variable vs fixed mortgage rate decision is one of the biggest a borrower will make when selecting their mortgage.

It’s a decision that will affect a homeowner for years to come and could be the difference in literally thousands of dollars of interest cost.

In 2025, as mortgage rates in Canada continue to fall from the highs of 2024, we will see that a fixed or variable rate mortgage may be best, depending on your unique situation and risk tolerance.

Here we will review the compelling reasons why the variable rate will make sense for some at this specific point in history. In contrast, a fixed rate, and more specifically – what type of fixed rate – might make sense given your unique situation and risk profile.

While protecting against higher interest rate risk is a central focus of this article, the other main focus is positioning your mortgage to take advantage of lower rates as they decline.

We will review the mortgage qualification questions you can ask yourself to determine your best answer.

Variable or fixed mortgage in 2025? Which is right for you?

To help determine this, we will look at:

- The difference between variable vs fixed mortgage rates.

- 5 Reasons why a variable rate could lead to more savings for years to come, including (Updated July 2025):

- Historical, long-term evidence of variable rate cost savings.

- When and by how much the variable rate is expected to drop.

- How to minimize the risk associated with a variable rate mortgage.

- How variable rates offer more flexibility and lower penalties than fixed rates.

- How to time a fixed rate lock-in.

- Why a fixed rate mortgage will be the best path for many. (Updated July 2025)

- Review and benefits of a 5 year fixed rate.

- Review of a 1-3 year fixed rate.

- The best questions and personal considerations to help determine your best rate strategy.

Variable vs Fixed Mortgage Rates: Features Compared

The short video below will simplify the variable vs fixed mortgage rate differences and provide a good basis for our discussion.

To summarize:

Fixed Rate:

- Locks your rate into place for a period of time called the term (usually 1,2,3,4 or 5 years).

- Rate is typically a bit higher, but provides for a stable, consistent mortgage payment for years to come.

- If you break the mortgage, there is often a bigger penalty called an ‘Interest Rate Differential’ penalty.

- Switching from a fixed rate to a variable rate without breaking the mortgage is impossible.

Variable Rate:

- The rate floats or changes over time, with decisions from the Central Bank of Canada.

- The rate is determined using a discount off of the Prime Rate (ex. Prime minus .50%).

- Typically, the variable rate is lower than fixed, but can also float higher for periods.

- If you break the mortgage, the penalty is typically far lower.

- You can lock the variable rate into a fixed rate at any time, without breaking the mortgage.

Variable Mortgage vs Fixed: 5 Reasons Why Variable Could be Better in 2025

Variable is Historically and Statistically Shown to Cost Less than Fixed

According to a 2001 report completed by Moshe Milevsky, Professor of Finance at York University Schulich School of Business, variable mortgage rates beat 5 year fixed rates 70% – 90% of the time.

Using data from 1950 – 2000 the study includes a period of high market volatility in the 1980s and 1990s when mortgage rates were much higher than they are at present, not unlike what we are witnessed in 2022 – 2024. This means that the data used in this study is not selected during a period that would manipulate the results to favour a variable rate over a fixed rate.

I believe it’s quite the opposite. I believe that the rate volatility in the 1980s and 1990s skews the argument more toward fixed rates, and that it is more likely for rates to remain lower over the long term than the peak rates seen in periods of high inflation.

With this said, in the author’s words “When interest rates are at low levels, one is better off locking in at long term rates”.

To summarize, the author of the study suggests that variable rates are the better choice much of the time, but locking into a fixed-rate mortgage at the right time can result in mortgage rate savings. We will address the variable rate lock in feature, later in this article.

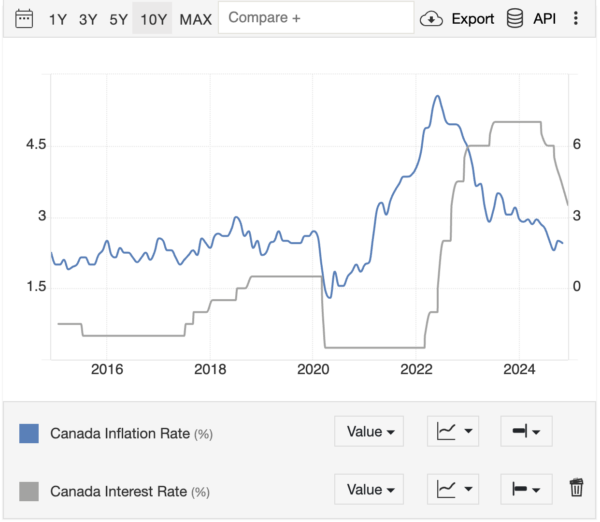

Some will point to higher interest rates during the 1980s and 1990s, and the more recent 2022 – 2023 rate increases as a reason to avoid a variable rate. This thinking is understandable, however, as we will review below, we live in a very different, debt-laden economy now whereby the effects of a 1% higher Central Bank rate has approximately 6 times the economic impact as a 1% higher rate did in the 1980s. Indeed, adjusted to inflation, private and public debt levels are currently more than 6 times higher than in the 1980s.

For example, a single family house in the 1970s and 1980s may have cost $50,000 with a $40,000 mortgage. Today, an average house in Canada costs well over $700,000 with many mortgages over $500,000. In the GVA and GTA, these numbers are more exaggerated.

These are different economic times, with different consequences of higher rates.

Therefore, even with high 8% inflation in 2022, we did not see the kind of high 10%+ rates that were seen in the 1980s and 1990s. Variable mortgage rates mostly topped in the 6% range for a period of 8 months, until rates ultimately gravitated downward as inflation was subdued. The variable rate strategy may be seen like a ‘buy and hold’ stock market strategy. Over the long term, you are likely to do well, as long as the shorter term periods of volatility can be withstood, or properly managed.

Variable rates are expected to drop in 2025

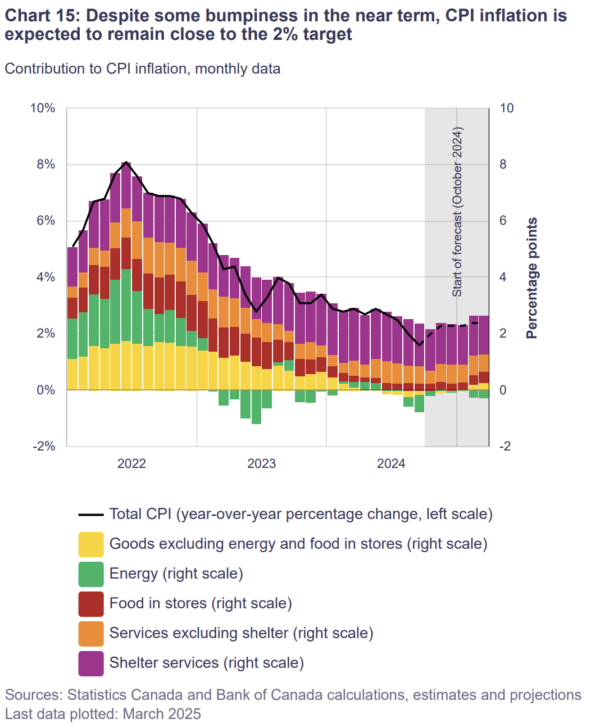

In 2025, the main prerequisite for variable mortgage rates to drop further is for inflation to remain under 2.5%.

It’s projected by the Central Bank of Canada, and by financial markets, that the economy will run slowly enough throughout 2025 for inflation remain under 2.5% and for rate cuts to continue. Looking at this statement more closely, there are 2 competing forces in the economy now:

- On one side there is government stimulus and recent population increases providing upward growth pressure.

- On the other side still higher interest rates and lower business growth in Canada, that are dragging on the economy.

Given the interplay between these competing forces, we are seeing a mixed economic reality, but a reality that has led the Central Bank of Canada to cut interest rates by 2% so far. The main data showcasing the effects of a weakening economy are:

GDP Per Capita: The size of Canada’s economy in dollars, divided by the size of the population.

Real GDP growth: This is Canada’s economic growth rate, minus the rate of inflation. For example, if economic Growth is 2%, and inflation is at 2%, then Real GDP is 0%.

Unemployment: Hitting 6.9% in July 2024 and expected to increase slightly in the coming months.

As of July 2025, these key data points are negative, indicating an economic slowdown, with many households feeling the pinch. (For more details on this see our Rate Forecasting Article)

On the other hand, considerable government spending and population increases are still leading to economic growth on the surface level. In other words, we have more people buying more total goods and services, but on an individual/ ’per person’ level, spending is dropping.

It is well known in economics that it takes up to 2 years for the effects of a rate increase from the Central Bank of Canada to have full impact on the economy.

Given the first rate increase was in March 2022, we are now witnessing the full effects of the rate increases. So even as rates drop, as we progress into 2025, we will continue to see the full effects of the rate increases. This affects maturing business loans, and tens of thousands of mortgages as fixed mortgage rates renew from the 2% range into the current 4% range.

Given this, the Central Bank of Canada believes rates are currently high enough to continue cutting rates through 2025 as inflation remains low, as a result of a relatively weaker economy.

So the bigger questions now are: WHEN do the rates drop? And, How low are variable rates likely to drop?

There are two views on when variable mortgage rates are likely to drop:

- Financial Market Forecast

- Central Bank of Canada Commentary

Financial Market Forecast:

According to financial market consensus, when looking at the Government of Canada Bond Yields and other interest rate sensitive market instruments, the Central Bank prime rate and therefore variable mortgage rates are likely to continue dropping:

July 30, 2025 Bank of Canada meeting: 80% chance of a hold

0.25% additional cuts implied by financial markets in 2025

Noting that financial market consensus changes over time as new economic information emerges.

It is seen that, although rates increased quickly in 2022 and into 2023, the rate cuts 2025 will be more gradual, keeping inflation in check at all times.

Central Bank of Canada Commentary

Although the Central Bank is not providing exact guidance on when they might cut rates, they are indicating that we are now on a downward rate trajectory with generally lower inflation into 2025 – 2026.

So, overall in 2025, we will likely see 0.50 – 0.75% of total rate cuts, and an equivalent drop in variable mortgage rates.

This would result in discounted variable rates settling in the 3.75% – 4% range in 2025.

If inflation does not hold under 2.5% as expected, for example if CDN or US government policy cause higher inflation, then these rate projections could be thrown off.

There in lies the risk of the variable rate.

Or on the other hand, if disinflation continues more than expected, if US tariffs hit the Canadian economy hard, or if there is a financial market crash or major ‘event’, there is potential for variable mortgage rates to drop much further.

How does the Central Bank prime rate differ from the variable mortgage rate?

It is important to note that the Commercial Bank (ie. RBC, CIBC, BMO etc…) prime lending rate is different from the Central Bank overnight lending rate. More specifically, the Commercial Bank prime lending rate is 2.2% higher than the Central Bank of Canada rate. This difference between the Central Bank and Commercial Bank rates is the ‘spread’ whereby the Commercial Banks make their profits, and this spread will typically remain consistent over the long term.

So what we see happen to the Central Bank rate, add 2.20% on to this. For example, at the current time of writing (January 1, 2025) the Commercial Bank rate is 5.45% (3.25% Central Bank of Canada rate + 2.20% spread).

Next, to arrive at your specific variable rate, the Commercial Banks and mortgage lenders will typically offer ‘prime minus’ discounting, such as prime minus 1%. So if you have a prime minus 1% mortgage, your mortgage rate would be 4.45% using this example.

Variable-rate questions and considerations:

Pre covid, for the year starting October 2018 the economy was doing well, the Central Bank Rate was steady at 1.75% and the Commercial Bank Prime lending rate was 3.95% at its 10-year high point. What would your rate be given the ‘prime minus’ variable rate? A prime minus 1% discount is a good example.

There’s a reasonable possibility that rates return to 2018/2019 levels. But even if rates bottom out 1% higher than pre covid (perhaps in late 2025), at 2.75% and bank prime at 4.95%, this will still position most variable rate holders in the 3.70% – 3.90% range.

Fixed or Variable Mortgage: How to Minimize the Risk Associated with a Variable Mortgage

Here we revisit the fundamental question of why we are even taking the time to discuss a fixed or variable mortgage. The answer for most is to save more money on their mortgage, in one way or another.

The strategy here will show you how to lower your risk on a variable mortgage while also setting you up to save substantially on interest over time.

I call this more specifically, ‘variable rate risk mitigation’ and it involves keeping variable rate mortgage payments higher than corresponding fixed mortgage rates, as variable rates across the market drop over time.

For example:

5 Year Variable rate 4.5% (February 2025)

$400,000 mortgage

25 year amortization

Payment: $2,214

5 Year Variable rate 3.75% (February 2026)

$400,000 mortgage

25 year amortization

Payment: $2,050

The way to mitigate risk is to leave the variable rate payment static at $2,214 as the variable interest rates fall.

As of January 2025 the variable rate is projected to be 0.50 – 0.75% lower or 3.75% in this example. So if you started at 4.50%, a 0.75% difference in rate is projected to have been created, as rates are gradually cut.

In the above example the difference in mortgage payment is $164 per month. So you would use the pre payment privileges in your mortgage to pay an extra $164 per month in principal payment to pay down your mortgage by the time rates reach 3.75%.

This added principal payment would reduce your mortgage balance much faster, increase your net worth, and reduce future interest payments substantially. It would mitigate the variable rate risk.

Also noting that for ‘true’ variable mortgages, the payment will not drop when the rates drop. Instead a request would be made to the Bank to reduce the payment along with the rate. Many mortgages are ‘adjustable rate mortgages’ where the payment rises and falls automatically with changes in the rate. So those with adjustable rate mortgages would need to be more proactive with the pre payment, unlike the true variable which will remain higher in accordance with this planning.

The main point to be taken from this example is to make extra pre payments on the variable rate, as a function of the falling variable rate.

Difference of 0.25% lower variable rate, over 5 years, per $100,000

Interest difference per $100,000: $1,194

Interest difference if savings is re-invested into the mortgage: $1,278

So on a $500,000, a 0.25% lower variable rate could save you $6,390 over 5 years

We have considerable experience with these variable rate vs fixed rate strategies at Altrua Financial, and customizing them perfectly for you. Connect with us at your convenience.

Variable mortgage vs fixed: How variable offers more flexibility and lower penalties than fixed

Closely related to lowering risk, as emphasized in the last point, the lower penalties and increased flexibility built into a variable rate mortgage are a cornerstone of a variable rate.

In fact, some mortgage and financial professionals go as far as to say the lower variable rate penalty is the main benefit of a variable rate mortgage, given how fixed-rate breakage penalties can easily reach into the $10,000 + range.

When looking at a variable vs fixed mortgage, it should be taken into account that, especially during the first 3 years of a 5 year fixed rate mortgage, the penalty to break the mortgage can be extremely high.

As a mortgage broker for over 17 years, I have seen many individuals faced with massive ‘interest rate differential penalties’, when breaking their fixed rate mortgage for any number of reasons:

- Moving

- Refinancing to pull out equity

- Switching into a lower rate

- Family changes

- Many more…

This trend was especially the case in 2021 as many who are in a fixed-rate mortgage in the 3% range were faced with cost-prohibitive penalties in the $10,000’s to break their higher-rate mortgage. This was not the case for those in a variable rate mortgage, and this kind of variable rate flexibility could certainly come into play again in 2024-2026 if fixed rates decrease more than expected.

While a detailed discussion of penalty details is beyond the scope of this article, the point is that most variable rate mortgages (the mortgage products without high penalty fine print) will only ever charge 3 months interest penalty if you end up breaking the mortgage. The 3 month interest penalty is far lower – often to the tune of thousands of dollars lower than comparable fixed rate mortgage penalties.

Five years, the standard fixed-rate mortgage term, is a long time, and it can be difficult to tell exactly how economics and financial markets will play out years into the future. So an important financial planning strategy is to remain flexible and agile to help accommodate changes.

The variable rate mortgage is, in many cases, the right financial tool to help accommodate these changes. But is it the only way to help increase flexibility and lower penalty risk?

We will take a close look at this question just below. But first…

Timing a Fixed Rate Lock-In?

One of the fundamental benefits of a variable rate is the ability to lock into a fixed rate.

At the beginning of the article we discussed an academic study by Moshe Milevsky that saw variable rates saving homeowners a majority of the time, however there were times in the interest rate cycle that a fixed rate would have been better.

Few can accurately time the market, however when the economy is soft and rates are lowered to stimulate the soft economy, this may be a sign that mortgage rates (fixed and variable rates) are closer to their low point in the cycle.

Buy high… the variable rate

Sell low… the variable rate

If mortgage rates temporarily dip to the mid 3% range, for example, you could lock in the variable rate to a fixed rate at a time when rates are lower. This involves simply calling the lender and requesting the lock in. There should be no additional documents required as long as payments are up to date.

If you are looking to lock in your variable rate, and if you see a much better deal at a different lender that the current lender is not willing or able to match, since the variable mortgage rate penalty is relatively lower, it can make sense to pay the penalty to switch lenders for the lower rate. The fact that mortgage holders can do this tends to keep lenders a bit more honest in fixed rate lock in offerings (but unfortunately, not always…).

As we will see, with a shorter term fixed rate, you could buy some rate stability to help weather these volatile times, while also leaving open the opportunity to renew into a lower market rate on the maturity date (renewal date) of the shorter term. It’s a similar strategy to reduce risk, provide some better stability and leave open some potential to have a lower rate sooner.

2025 Variable Rate Analysis Conclusion

While it’s projected by financial markets and leading economists that within the year, the variable rate is to be approximately 0.25% lower than current fixed rates in the low-mid 4% range, there is no guarantee.

For those who rely on todays best/accurate economic data, the efficiency of markets and historical patterns of the variable rate, there could be considerable savings over the next 5 in variable rate as we enter a new economic cycle. But realizing these longer term savings will take a higher risk profile in 2025 as we have yet to see how inflation will react to higher government spending and tariffs.

Why a fixed rate mortgage will be the best path for many

As we move further into 2025, fixed mortgage rates have trended lower. Fixed mortgage rates do not move with Bank of Canada changes, like the variable rate does. Instead fixed rates are priced along with the Government of Canada Bond Yields, and are priced on a daily basis according to trends in the bond market.

As inflation finds its way lower, and as prospects of a recession increase, fixed rates will remain lower, ahead of, or in anticipation of, Central Bank rate (i.e. variable rate) decreases.

However fixed rates are already pricing in another 0.25% Bank of Canada rate cuts, so today’s lower fixed rates won’t drop like variable rates. In fact, we are more likely to see fixed rates increase slightly in 2025, whereas we would reasonably see 0.25% – 0.50% of variable rate drops over the next year.

Accordingly, given current economic data, fixed mortgage rates in the high 3% – low 4% range are likely to be good value.

Why fixed rates more specifically?

Stability and Peace of Mind:

How does one measure peace of mind? It’s nearly impossible to measure, and its value can be near infinite. What’s the point of saving $5000 on your mortgage if you’re going to lose sleep for the next 5 years? It’s not worth it in this case.

Along with peace of mind, the fixed rate mortgage will provide better stability and consistency in payments during this volatile time of more ‘what ifs’. If inflation rebounds, rates could remain higher for longer and fixed rates could even increase from here.

The benefits of a 5-year fixed rate.

- Currently the lowest rates – much lower than 1-2 year fixed rates.

- With fixed rates generally in the low 4% range, variable is not projected to be much more than 0.25% lower than todays fixed rates, even in 2026.

- To save more with a 1-2 year fixed rate vs a 5 year fixed, this requires Bank of Canada cuts inline with today’s projections. If the Bank of Canada does not cut rates (variable rates) then you will not likely save with the 1-2 years fixed on the renewal date. In other words, if you’re counting on a lower renewal rate in 1-2 years, you’re counting on variable rates to remain in the high 3% range for 2+ years.

- More protection and peace of mind as we are in a unique and less certain point in history.

Top benefits of a 3 Year fixed rate.

- Slightly higher than a 5 year fixed, but potential to renew sooner when rates are lower.

- Rates could be higher in 3 years if inflation returns due to a lower CDN dollar or inflationary government policy.

- Rates could be lower in 3 years if economic growth and inflation remain low.

- Better for those with a medium-higher risk tolerance.

Top benefits of a 1-2 year fixed rate.

- If selling your home in 1 year and not buying, you can avoid penalty with a 1 year term.

- If you are increasing and blending an existing mortgage rate, you may end up with a compelling low 1-2 year fixed rate.

- If requiring a higher rate alternative or private mortgage and looking to exit the high rate as soon as possible, a 1 year term usually makes the most sense,

Some questions and personal considerations to determine your best fixed or variable rate strategy.

- Do you have a good understanding of how the variable rate works, and how swings in the rate can affect your mortgage payment?

- If you were to buy an investment, such as a mutual fund, would it be:

- Conservative? (low risk, more stable, lower potential return). Consider a 5 year fixed mortgage rate.

- Balanced? (moderate risk, more volatile, but more opportunity for higher returns). Consider a 3 year fixed rate.

- Growth? (more risk, the maximum opportunity for a higher return.) Consider a variable mortgage rate.

- If you’re unsure of what investment category you’d fit into, try googling an investment risk profile to see where you might end up.

- Are you comfortable if the variable rate increased slightly higher, and could potentially increase further than projected?

- Beyond theory, if you see and feel rates increasing, will your feelings be the same? Or are you more likely to stand by your initial strategy if emotions run higher?

- Do you have some excess or can you create excess cash flow to manage higher variable rate payments? Or would potentially higher variable rates put you in an extremely uncomfortable or dangerous financial position?

- Have you calculated what your maximum tolerable mortgage payment can be? What kind of variable rate would this look like? Are you comfortable with this rate?

When working alongside an experienced mortgage professional, your answers to these questions and others will help you arrive at your best answer.

The decision can be made decisively, but if you have not arrived at your best answer immediately, sleep on it for a few days or weeks until your decision becomes most apparent. The decision should not be made based on the positive or negative news of the day. That news is designed to swing your emotions. But instead based on a conviction to hold the course for at least a few years understanding there will be swings and unexpected events in the financial markets.

If differing views between spousal partners, consider splitting or balancing the risk and strategy.

Thank you for reading, and connect with us at Altrua for answers to your questions and a customized approach to deciding on rate.