Ground Level Updates on Mortgages and the Housing Market, before it hits the news

🚨 Bond yields are up ~7% on the week 🚨

If this holds through tomorrow, fixed rates will be increasing 0.10 - 0.15% across the board and may be headed even higher

This is not a drill

If youre up for renewal, reserve your rate ASAP

Fears of a credit crisis and geo political risk gave way to anticipation of higher inflation due to a spike in oil prices Monday morning

Accordingly, Bond yields lept ~3.5%

A sustained war of 2-3 weeks+ could result in an inflationary trend and upward fixed rate pressure

We are seeing some of the lowest fixed mortgage rates in over 3 years:

5 YR fixed @ 3.69% for purchases and 3.79% for renewals

VRM still carries upside risk, but the outlook is improving

BoC odds have pulled back from 4 hikes (1%) over the next 5 years to 3 hikes (0.75%)

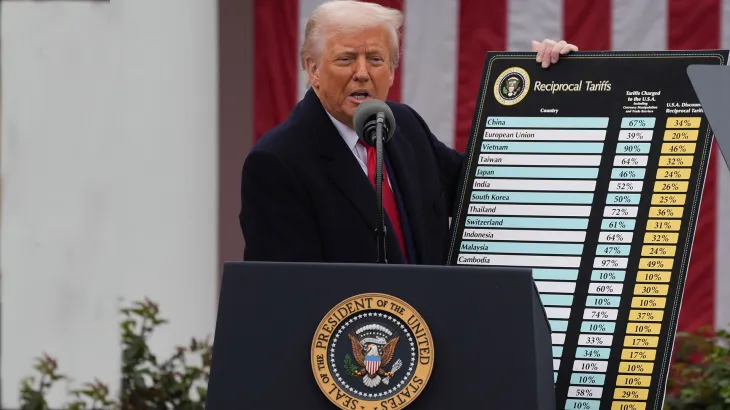

And bond yields barely flinched on the news… among all the tariff noise, the bond market has remained cool as a cucumber

BREAKING: The Supreme Court of the United States has officially ruled that President Trump's tariffs are illegal, in a 6-3 ruling.

The US now faces $150+ billion in potential tariff refunds.

🇨🇦 CPI/ inflation in January lowered by 0.1% to 2.3%, slightly under consensus of 2.4%. Excluding gasoline, inflation was 3%

This, plus investors moving to safety in bonds/lower yields prompted some banks to reduce fixed rates by ~0.05%

Odds of a BoC March cut increased to 13%

$PYPL plan to buy back $6B of shares in 2026 could be a terrible strategy if the business decelerates

Until growth stabilizes, management should allocate capital to growing assets - even treasuries

Otherwise its just more good money after bad

Check out the latest edition of my newsletter

It discusses the Canadian jobs market and market volatility in software, AI, Bitcoin, Gold and Silver

Canadian Jobs Lost, But Unemployment Down

Canadian Economic, AI, SaaS, Crypto, Gold and Silver Update

www.richreport.ca

The 🇨🇦 jobs market in Jan moved in several directions at once:

• Unemployment📉to 6.5% due to exits from the workforce

• Full time:📈by 45,000

• Part time:📉70,000, netting 25,000 lost jobs

Financial markets ultimately shrugged it off; mortgage rates remain stable

The Ontario and Federal governments have invested $ hundreds of millions into this plant, with earmarked subsidies of up to $15 Billion

Stellantis just sold its stake for $100

Stellantis selling stake in Ontario battery plant as part of wider EV reset

Automaker Stellantis is selling its 49 per cent stake in an Ontario battery plant to its joint venture partner L...

ca.finance.yahoo.com

We are Mortgage Brokers proudly serving customers from 5 locations in Ontario.

Kitchener/ Waterloo (Head Office)

In Kitchener Waterloo Call: 1-877-248-9210

Hamilton

In Hamilton Call: 905-538-0677

Privacy Statement:

Altrua Financial Inc. is exceptionally committed to respecting the privacy of individuals and recognizes a need for the appropriate management and protection of any personal information that you agree to provide to us. We will not share your information with any third party outside of our organization, other than as necessary to fulfill your mortgage request.