The difference that negotiating your mortgage renewal rate in Canada can make is stunning. Given an example of a $500,000 mortgage and a 25 year repayment period, a 0.50% lower mortgage rate over this time can reasonably add up to $61,727 in mortgage interest savings.

As a Certified Financial Planner (CFP) and Canadian Mortgage Broker of over 16 years, with over 500 mortgage renewals completed, I’ll share with you the best mortgage renewal tips and the 5 step mortgage renewal process to help you quickly and easily negotiate a lower rate and save thousands.

(Renewal FAQ section is at the bottom)

When to start shopping for your best renewal rate

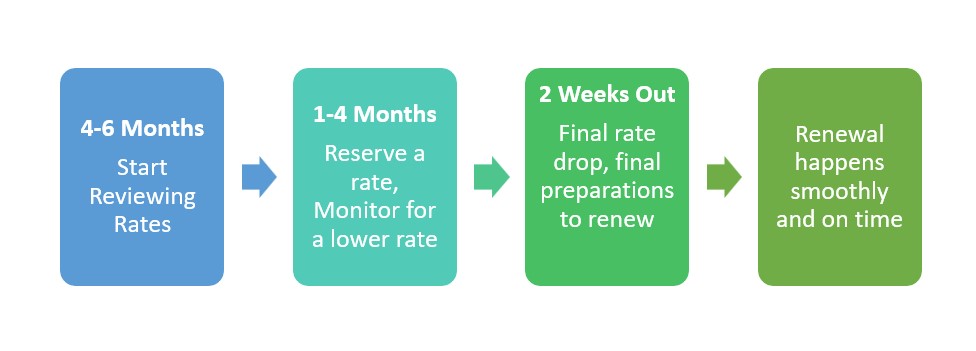

Since mortgage rates can typically be held for 120 days, this is usually a good time to start shopping your mortgage renewal. However, your existing lender might contact you up to 6 months in advance offering an ‘early renewal’. If you are considering an early renewal, it’s a good idea to start shopping at that point. Conversely, if you’re running behind, it’s never too late to start shopping for your renewal.

Here is a typical timeline of events that helps illustrate the mortgage renewal process.

Get a basic understanding of the current mortgage rate market and strategies

Get to know what type of rate makes the most sense for you at this point in your mortgage, as this will be an important piece of the savings puzzle and your negotiation.

Your bank may want you to take a 5 year fixed rate, but is this the best rate in 2023?

To summarize the current mortgage rate outlook, as of April 2023, its projected that fixed mortgage rates will generally be on a downward trend for the remainder of 2023 and throughout 2024. With variable mortgage rates forecasted to drop in late 2023 or early 2024.

Knowing this, it may not make sense to lock into a longer term, fixed rate mortgage such as a 5 year fixed. A 3 year fixed rate will be up for renewal sooner, at a time when rates are likely to be lower and this could save you thousands.

For more information on mortgage rate forecasts and strategies, check out our articles (opens in a new window):

Mortgage Rate Forecast for 2023 – 2024

The Ultimate Mortgage Rate Guide in 2023

Or connect with me at Altrua today for a no obligation conversation.

Have a good idea of your financial and home ownership goals for the next 1 to 3 years

Some good questions to ask yourself are:

- Do I have any major expenses or projects coming up that will require low cost financing?

- Are there any higher rate debts worth consolidating into one lower cost payment?

- Is there a good chance I might be moving in the foreseeable future?

Having a good idea of your goals will help to structure your best renewal strategy, mortgage features/flexibilities and term length.

What to say to your existing lender to get their best renewal mortgage rates

Now that you have a better idea of the mortgage rate market and your goals, it’s time to contact the mortgage department at your current lender.

When speaking to your current lender, the main thing to discover is their lowest possible renewal rates. Lenders often have a range of rates they can offer (floor to ceiling rates), and will only offer their lowest floor rate if there is a threat they will lose your business.

Given this, let your current lender know:

(1) That you are shopping for the best rate

(2) That you understand there may be some discretionary rates available and

(3) Let them know that this is their chance to earn your business, not later on after you’ve already done the work to find a lower renewal rate elsewhere.

Be pleasant and diplomatic in your conversation, and let them know if you’ve appreciated them so far and if you want to give them the best possible opportunity to keep your business.

Get other mortgage rate quotes

The standard advice for any major purchase is to get more than one quote. So it’s worth visiting at least one, if not two other mortgage broker or lender sources for quotes. Usually, a broker that provides mortgage renewals online will produce a highly competitive rate so this can be a good place to focus.

At Altrua Financial, we consistently provide the best market rates in Canada the first time you ask and guarantee the best mortgage rate on your renewal. It usually only takes 5 minutes to discover and accurately quote your best rate through our online mortgage renewal process.

Once you are armed with one or two highly competitive rate quotes, you’ll have the decision to return to your existing lender or not. If you prefer to remain with your existing lender, you may be able to get an even lower rate with them. But if you get better, more personalized advice and have an overall better experience elsewhere, and want this to continue, then it may be worth the small amount of time to switch over.

The process for renewal with Altrua is completely online, with minimal paperwork and takes about an hour or so in total, depending on questions and requests. Connect with us today.

Renewal Mortgage FAQs

What happens at mortgage renewal time?

Renewal time happens at the mortgage term ‘maturity date’. At this time, your mortgage rate is up for renegotiation and new market rates will apply. You may choose to remain with your existing lender or switch to a different lender if a better deal can be found. If you switch lenders, the ‘mortgage instrument’ registered to your home is transferred from one lender to the next and transfer costs are typically covered by the new lender.

Can I renew my mortgage early?

A mortgage can typically be renewed with the same or a different lender at any point in the term. However, if renewing early there will likely be a penalty that applies, and this penalty should be clearly known as part of a cost/benefit analysis before any final decision is made.

Can you pay off your mortgage at renewal?

At renewal time, your mortgage can be completely paid off without penalty. On the maturity date, the mortgage is ‘open for a day’ so to speak and if you have the funds arranged either from personal savings, or from a different lending source, then it can be arranged for your existing lender to be paid out.

Can I change my Amortization at renewal?

During the renewal process, it is possible to reduce your mortgage amortization as long as your mortgage continues to qualify with the higher payments. If you wish to increase your amortization, typically this can only be done with a refinance, unless you have made significant prepayments throughout the term.

Mortgage Renewal vs Refinance?

A mortgage renewal can be thought of as a continuation of the existing mortgage, whereas a mortgage refinances involves paying out the existing mortgage and starting with a new mortgage. When starting a new mortgage, there are more options for increasing the mortgage amount to access equity and extending the mortgage amortization, potentially reducing your payment. Refinance rates tend to be a bit higher than renewal rates, however, the overall savings and benefits of a refinance will often outweigh the savings of a lower renewal rate.

For more, check out our mortgage renewal vs mortgage refinance page here

What happens if your mortgage renewal is denied?

Sometimes, if there has been a history of missed payments, this can trigger banks and lenders can do a soft credit pull to see where your overall finances are at. If they are not comfortable with what they see, they may send notices that they will not renew. In this case, its important to remain calm, and shop the market for a solution. There is often a good solution

Canadian Renewal Resources

Calculators:

Mortgage Renewal calculator (opens in a new window – then click ‘renewal’)