Altrua Financial is a leading mortgage broker in Mississauga, having completed over 1900 mortgages over the last 17 years.

Brent Richardson, Principal Broker/ Owner and Certified Financial Planner (CFP), works to enhance long-term mortgage savings and increase your net worth. We are focused on mortgage education and advice to support informed approvals and your peace of mind.

Fast service that saves you time and reduces stress, but not at the expense of the best mortgage rates in Mississauga.

Your Mortgage in 4 Easy Steps

I’d Like To…

What Clients are Saying

“First time home buyer with no knowledge of the process and was helped by Marta. She was very prompt and patient to address any concern i had. She helped me secure my first mortgage and I was very happy with her professionalism and great attitude. I would definitely recommend her to everyone… Thanks again Marta for all your help and making my experience very memorable. God Bless” – Harrison O

“My renewal with a previous mortgage lender was coming on May 8,2020. However, the previous lender offered me with a higher interest rate. So, I found this Altrua financial. Brent and Marta were very helpful and professional finding a best mortgage interest for me at 5 yrs fixed. I also did not need to contact my previous lender for switching to another lender. Every process was informed and I would definitely recommend this service to anyone who likes to find the lowest rate and high quality service. I am happy with the service that Altrua financial provided to me. Thank you so much for all your work that you’ve done for me. I will use your service next time again.” – Eileen J.

“Altrua was great. Tim was awesome to work with. He got us a fantastic rate and the whole process was very easy to do.Would highly recommend Altrua to all my family and friends. It’s worth the time to call/email” – John H

“I’ve been coordinating with Tim in altrua to find better rates for my mortgage, I’ve met many mortgage brokers and big banks to get better rates but all rates come with hefty fees and limited features.

Tim helped me to find the best rate with a full feature mortgage, brought multiple options and guided me thoroughly, I am happy that I closed the mortgage with his help , He was responsive throughout, patience and organized to keep everything on track

I highly recommend to home buyers check with him before closing any mortgage with the big banks”

– Moutasim B.

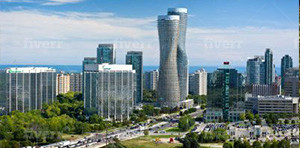

Our Mississauga Location

55 Village Centre Pl, Mississauga, ON L4Z 1V9

(905) 821-7010

About Mississauga

Mississauga is the largest suburb in the GTA, and is home to a growing population of about 950,000.

Even though Mississauga is critically dependent on Toronto for growth and employment, in recent years, the City has developed its own downtown area in the City Centre/Square One Mall area.

You’ll find several Mortgage Brokers in Mississauga, but only Altrua Financial offers the lowest rates combined with strategic wealth planning. A considerable number of larger condo complexes are being built in this area to intensify, rather than sprawl, especially in the Square One and Eglinton areas. This not only helps with environmental concerns but also builds a sense of local community.

Speaking of community and local quality of life, Mississauga is home to a vast array of stunning trails and parks that will make one feel like they’re not in the City at all. Balancing out the surprising availability of tranquillity in the area are sprawling business parks that are proud to host the Canadian headquarters of major corporations such as Mercedes-Benz, Hewlett-Packard, Bell Canada, Hershey’s, and hundreds of others.

Mississauga is home to the Pearson Airport, serving the GTA, and the GO Train zips locals into any area of the GTA in just minutes.

According to the Mississauga Real Estate Board, home sale prices in the Mississauga area have been steadily decreasing in late 2025. This is likely due to economic uncertainty in 2025 and does not reflect the area’s desirability.

As Mississauga mortgage brokers, we ensure that, no matter the market, we can use your home to build wealth faster, leveraging the same growth strategies used by Canada’s wealthiest. With fixed rates under 4%, there is no cheaper access to equity than your home, and we can help guide you to use this equity in the most proven and productive ways.