As a Canadian Mortgage Broker and Certified Financial Planner (CFP) with over 16 years of experience and over 1700 online pre-approvals under my belt and NO mortgages that did not close, here are the advanced mortgage pre approval tips you need to know in 2025, including:

- A Review of the 3 Fundamental Pillars of a Mortgage Pre Approval in Canada

-

- Down payment

- Credit

- Income

- The ‘must have’ Documentation checklist

- Advanced Pre Approval strategy

- How to extend your rate hold for longer than 120 days

- Rate Float Downs and ensuring the best mortgage rate

- Avoiding the mortgage fine print minefield

- How to increase pre approval amounts, if desired

- Pre Approval to Full Approval: What to watch out for

- Summary: The Online Mortgage Pre Approval Process Step by Step

- FAQs

The 3 Fundamental Pillars of a Mortgage Pre Approval in Canada

A pre approval for a mortgage mainly comes down to reviewing three things:

- Down payment

- Credit

- Income

Here we’ll take a closer look at minimum lender requirements surrounding each area, and some time-tested tips to help you get ahead.

Down Payment

The down payment is the money you bring to the table when buying a home. It is your ‘skin in the game’ from a lending perspective.

The minimum down payment in Canada is currently 5%, whether you’re a first time home buyer or not.

Advanced down payment tips:

- Any mortgage with less than 20% down payment needs to be default insured, or ‘CMHC insured’. This involves an insurance premium ranging from 2.80% – 4.00% of the mortgage amount, as a one time fee, and is built into the mortgage.

- The CMHC premium decreases as the down payment increases by increments of 5%. So if you’re close to 10% or 15%, it could save you thousands to get there.

- For any purchase price over $500,000, the minimum down payment is 10% on each dollar of purchase price over $500,000. Ex: $750,000 purchase price minimum down is $50,000 ($25,000 on the first $500,000 + $25,000 on the next $250,000).

- If the purchase price is over $1,000,000, the minimum down payment is 20%.

- Down payment can come from either a personal savings/investment source or a gifted source. If gifted, the funds transferred to your account should be from immediate family.

- Keep in mind there will be closing costs in addition to the down payment. It’s important to provision for an additional 1.5% of the cost of the home to close the purchase with a lawyer, and for spending money after the closing.

For more detailed information regarding down payment check out: Our Guide to Down Payment

Top Tip:

As you prepare to buy a home, try to minimize the number of large transfers between bank or investment accounts. Upon FULL mortgage approval once you have bought a home, banking regulation requires that lenders review the past 3 months of investment or bank account history, and are required to trace any funds entering your accounts, to their source account. If there are a lot of funds transfers, this can really add up the paperwork involved! And potentially lead to issues if funds cant be properly sourced.

Gifted funds from immediate family typically only need to show a gift letter, NOT a 3 month source account history.

Credit

Credit forms a core part of the pre approval, because it demonstrates an applicant’s ‘willingness to pay as agreed’. Since the mortgage is probably the highest level of borrowing, credit gets reviewed closely during the mortgage pre approval process.

Advanced tips about credit:

- The score in Canada ranges from 300 – 900 and any score over 640 typically qualifies for a prime rate/ low rate mortgage. Any score over 680 typically qualifies for the lowest prime rates.

- A credit profile should contain at least 1 credit card for at least 2 years with good repayment history. 2 credit cards or types are recommended to optimize your score.

- If there are missed payments, or card balances near their limits this will lower the score. Isolated instances of missed payments can be OK, but consistently missed payments over time can be something to work on.

- If new to Canada, there can be exceptions on credit.

- Any existing credit card payment or loan payment will be incorporated when calculating the pre approval maximum.

Top Tip:

There is a ‘bankers myth’ that every credit pull will lower your score. This isn’t true, and according to the Equifax and Trans Union credit reporting agencies, 3-4 credit report pulls within a few months time frame should NOT lower your credit score. It’s completely normal for a few credit pulls to happen when shopping for a large purchase, including a mortgage pre approval.

However, as a preliminary measure, viewing free credit reports online, or reports seen in online banking does not appear on your credit report at all, because it is a ‘soft pull’.

Income

With (1) a good credit score and (2) a down payment of at least 5% you’re PRE APPROVED!

But the big question now is, how much is the pre approval for?

Here’s where income comes in.

As a basic rule of thumb, in 2023 for every $100,000 of income in an application, this can result in a mortgage amount of approximately $450,000. This is a general approximation and could be higher or lower depending on the application and where interest rates are at.

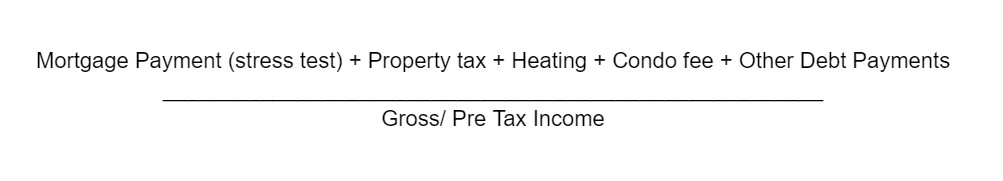

More specifically, when calculating income lenders will use a simple math formula called a ‘Total Debt Service Ratio’ (TDS). To help determine affordability, this central calculation compares housing expenses and existing debt payments to income.

The expenses cant be over 44% of pre-tax or gross income. If looking at ONLY housing expenses with no other debts, the limit is typically 39% of income.

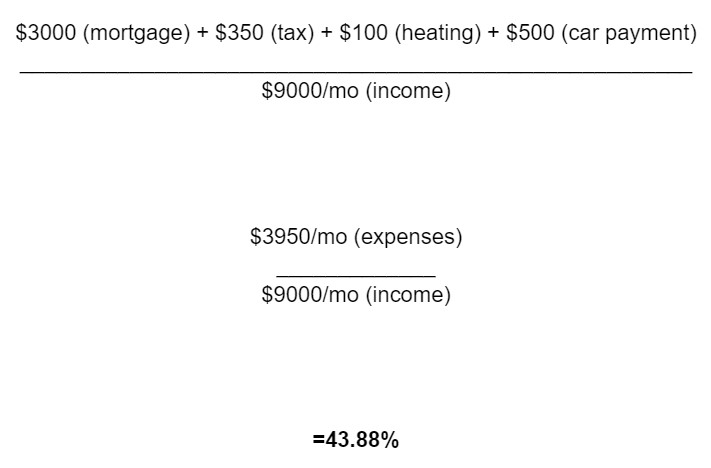

For example:

In this example, because the TDS ratio is less than 44% this mortgage payment fits within the pre approval range. But remember:

- If there is no other debt payments in the picture, the maximum ratio is 39%. With other debt payments, there is some extra ‘wiggle room’ to 44%.

- The payment is calculated based on a higher ‘stress test rate‘. If you plug the actual payment into these ratios, there is approximately a 20% difference in the maximum. Beware the stress test and always calculate using the stress test rate, which is typically 2% higher than the contract/ pre approval rate.

- With 20% down payment, there can be exceptions to maximum debt ratios.

As important as how the income is calculated, is how the income is paid to the borrower because this can directly affect how much income can be used in an application.

Is it employed or self employed income? Is it salaried or hourly? Contract or permanent work? Bonus pay, overtime or commissions earned?

The main rule of thumb for income is, the more consistency in income the more we can use towards the pre approval.

Here’s a review of the most common income categories and how they are treated by lenders:

Salaried income: If using a base minimum salary, this is considered to be the most consistent and stable form of income and typically 100% of the salary can be used at face value.

Hourly (with minimum weekly hours): This type of hourly income is considered the same as salaried income.

Hourly (without a weekly hourly minimum): Since hours could potentially fluctuate greatly, this type of income requires a 2 yr average from the same or very similar employers.

Overtime/bonus/commissioned/ fluctuating income: Wherever there is an income source or a component of the income that can fluctuate, a 2 year average of this income is required if we want to involve the fluctuating income.

Self employment income: This type of income relies most heavily on the past 2 years of income tax returns and the net/ after expense/ taxable income. However, there are some self employment programs that can help to increase usable income.

Contract income (not permanent): If on a contract, typically, we need to show 2 years of the contract income to use this income. However, if the contract can be confirmed by the employer as potentially renewable, then less than 2 years may be acceptable.

Top Tip:

If all mortgage applicants took heed of this one mortgage pre approval tip, this would likely reduce 75%+ of financing issues in Canada.

Indeed, if there is an issue later on with the mortgage approval, it’s often because there was some form of miscommunication or misunderstanding surrounding how income is paid. But providing an employment letter, recent pay statement and possibly 2 years of income tax history up front, can go far to alleviate potential issues.

By this point, you might be asking, ‘If the income documents are so important, what are ALL the documents needed to help ensure my best pre approval and no issues later on?’

‘Must Have’ Pre Approval Mortgage Document Checklist:

Every person’s situation and mortgage approval are different, and so will the exact documents required to pre approve and close your mortgage. With this said, the following are the most common documents needed to help ensure a bulletproof pre approval.

Income:

- Employment letter (standard confirmation of employment from HR, payroll or a manager).

- Recent paystub (showing pay in line with employment letter and income taxes, CPP, EI deducted).

- Past 2 years T4 tax slips (if an income average is needed or benefits you) or T1 General tax forms if self employed.

Down payment:

- Lenders are required by Canadian Federal regulation to review down payment in a bank account or investment. Lenders typically require 3 months of banking history to trace down payment funds.

- Typically the 3-month account histories can be found in online banking and easily downloaded/ ‘print to PDF’.

- Gifted funds from immediate family will require a gift letter to trace funds. A different gift letter template is provided by each respective lender.

Other:

- ID – drivers license, passport, PR card

- VOID Cheque or Pre Authorized Debit form from your Bank

- Lawyer name

- MLS/ listing of the property that you will be making an offer on

Advanced Pre Approval Strategy

How to Extend Your Rate Hold for Longer

Typically banks can grant a rate hold for up to 120 days at a time. However, there are two ways to potentially improve on your rate hold.

One is to simply hold off on requesting the rate until rates threaten to increase. If rates are dropping or holding steady, what is the benefit of reserving a rate? However if, for example, a month later rates are threatening to increase, then that would be a good time to lock in a rate. In this example, you’ve just bought yourself an extra month rate hold by timing when to lock in your rates. A good mortgage broker who monitors markets and receives timely lender updates, knows when fixed rates will increase and will work with you to position your rate hold strategically.

The strategy other is to work with a mortgage broker that works with multiple lenders. Having more than one lending source opens the potential for more than one rate hold if needed, however different lenders will probably have different rates.

Rate Float Downs and ensuring the best mortgage rate

Over 80% of the time, the rate holds that are used for pre approval are not the lowest mortgage rates that you will see if you have an accepted offer to purchase a property.

Upon full lender approval, be sure to request a rate ‘float down’ or discretionary rate – even if market rates haven’t dropped. A good mortgage broker will do this automatically, but many in the mortgage industry will not because it improves profitability. Many of the deals seen online too, are only available on full lender approval and so this should be considered as well.

The idea of a pre approval rate hold is that it protects against potentially higher rates, but right up and until 2 weeks before the closing/ possession date of the property, there is a potential opportunity to lower your rate further.

A good broker will help you monitor rates for the entire time.

Check out our guide for getting the best mortgage rate: Ontario Morgage Rate Guide

Avoiding the mortgage fine print minefield

Ensure that the pre approval conversation includes some details of the mortgage fine print. There are many mortgages in Canada that offer a lower rate to pull in the business, just to make up their profits in the fine print later on after the mortgage is closed and rate shopping is done. Ensure that whoever you’re partner with on your pre approval offers a good explanation of fine print flexibility in the mortgage, with no unusual surprises or catches in the fine print.

Having a quick fine print conversation early on during the pre aproval can set you up for success since fine print is a point that can be missed once a property is found, things are moving fast, and emotions are running high.

How to increase pre approval amounts, if desired

There are a number of strategies available that can result in higher pre approval amounts. The skill with which these strategies are implemented too can make a big difference.

- Debt structuring: If there are other debt payments in the application, paying down debt strategically can lead to higher pre approval amounts, even if this reduces down payment available.

- Gifted down payment: As long as the gift is from immediate family, this can potentially be a way to improve the pre approval amount.

- 20% down payment: If stricter CMHC lending rules can be avoided, there are many more options available. Banks will often stretch lending ratios and some credit unions can pre approve with no stress test rate. 30 year amortizations are also available to help lower payments.

- Cosigner: If a co signer is available, they may sign on to the mortgage for a year or two and then come off once the primary borrower can qualify on their own.

- A combination of these strategies can significantly boost the mortgage amount you’ve been pre approved for.

What Makes a Pre Approval different than a Full Approval?

While the pre approval focuses on the borrowers themselves and their ability to qualify for the mortgage and payments, the full approval turns the attention include the purchase property.

A full lender approval can be applied for once the buyer has an accepted offer to purchase. This accepted offer to purchase might have a financing condition or it might not, depending on the negotiations. But as long as there is an accepted offer, a full approval can be applied for because now we have the property address and details that we can merge with the borrower information.

Here are the most important things to note about a full approval:

- Does the property have any major deficiencies or structural problems? For example, if there is water damage or mold, foundational damage, or an unfinished part of the home, lenders may not want to proceed with that specific property, even if you are well pre approved.

- Does the listing/ MLS wording contain any terms such as ‘handyman fixer upper’, ‘sold AS-IS’, or ‘development opportunity’? These types of terminology can be a red flag for lenders and they will want to take a closer look at the property on full approval to sure it is in good condition.

- The property listing will contain the property tax amount, potential condo fees, and approximate heating costs can be determined from the size of the property. If the pre approval is near its maximum and the other housing costs are on the higher end, caution should be taken to ensure the affordability is still in line with the pre approval.

A pre approval that includes the MLS/ listing that you plan on making an offer on will help to avoid property related issues.

It usually takes about 1 full business day to go from a pre approval to a full lender approval, sometimes a bit longer if the lender is very busy.

On full approval, a ‘mortgage commitment’ or contract is produced by the lender that lays out in detail, all the terms of the mortgage. The rate on a full approval is held up until closing but if rates drop, then a rate ‘float down’ can be requested for the same approval.

A summary: The Online Pre Approval Mortgage Process Step by Step

The steps of an online pre approval and purchase are easy to follow, and an understanding of the process will help to provide confidence as you proceed. The following is our online process at Altrua Financial and provides for a good summary of the information above.

- Initial ‘pre’pre-approval call to determine a rough pre approval maximum range, and answer questions.

- Fill out a secure online mortgage application for pre approval and gather supporting documentation. Our application system automatically requests the right documents for secure upload.

- Happy house hunting! Onceyou are interested in a property and are planning an offer,, send Altrua the MLS. Once an offer is accepted, send the signed offer to purchae document to Altrua.

- Discussion and confirmation of mortgage type/rate/ product and submit for full approval. Full lender approval usually takes 1 -2 days.

- Full lender mortgage approval is reviewed, your questions are answered and a secure digital package is sent for digital signing.

- Altrua does the legwork with the lender to close the mortgage along with providing supporting documents and a signed mortgage approval document to the lender..

- The lender communicates directly with your lawyer, and you visit the lawyer within approximately 1 week of closing to complete the transaction.

From here its recommended to connect with us at Altrua so that we can answer any questions you may have. Typically a mortgage pre approval call can be completed in about 15 – 30 minutes depending on questions and the specific application. The call is no cost or obligation and will bring to life the information seen above when applied to your unique situation.

FAQs

What is a Mortgage Pre-Approval?

A mortgage pre-approval is a process that confirms a borrower’s likelihood of obtaining mortgage financing. Typically credit, income and down payment are reviewed during the process, but not the purchase property since the borrower has not found one to buy yet.

How Long Does Pre Approval for a Mortgage Take?

How long a pre approval for a mortgage takes depends on who is doing the pre approval. However, at Altrua, we can usually complete a reliable pre approval in 10 -15 minutes.

How Long Does a Pre approved mortgage Last?

Technically as long as there are no changes or setbacks (only positive changes) to the borrowers financial picture, then the pre approval can last for years. However a rate hold, which can be part of a pre approval, typically guarantees a rate for up to 120 days. Typically a rate hold makes sense if mortgage rates are threatening to increase. If rates are decreasing, then a rate hold does not make sense as part of a pre approval.

What do Pre Approvals Look Like at Various Banks?

What Credit Score is Needed for a Mortgage Pre Approval

For an ‘A’ low rate mortgage typically a 640 credit score minimum is required. At this level there would need to be a reason provided why the score isn’t higher. A good mortgage advisor can help to sort this out if your score is on the lower side. Otherwise if your score is above 680 then this is considered to be a good score.

What Documents Needed for a Mortgage Pre-Approval Canada?

The documents needed for a reliable pre approval include a letter of employment and eventually, proof of down payment. Your Broker or Banker can pull a credit score if you have not recently obtained one online.

Can I get Pre Approval Mortgage Online?

Yes, Altrua offers pre approvals online and over the phone. Typically a phone call of at least 10 minutes is required – however often it can take a bit longer with additional questions about the mortgage process and rates.

How Much does a Pre Approval for a Mortgage Cost?

Through most Banks and Mortgage Brokers, the pre approval is free. There is no cost or obligation with a pre approved mortgage.

What is a Mortgage Pre Approval Letter?

A pre approval letter may be provided by your Bank or Broker and can be used when making an offer on your home. At Altrua we provide well written letters of pre approval that show your strength to property sellers, and that help our borrowers win offers more often in a competitive market.

The Best Mortgage Calculators

Mortgage Affordability Calculator

Credit Score

Credit Karma (FREE) – The top free online credit resource.

Equifax – Go straight to the credit agency itself for the most accurate update (small fee)

Transunion – A second less popular but still huge credit reporting agency (small fee).

Mortgage Rates

Altrua Mortgage Rates – The lowest rate combined with trusted mortgage advice.

Closing Costs

Be sure to have at least 1.5% of the home value available as a closing cost. Even if you do not require this much (as in the case of a first home, you will likely NOT require this much), it still is helpful to have a cash buffer/ safety net in your account for after closing. Be sure to have at least 1.5% additional funds available in some way or form.