Mortgage Rate Forecast Canada 2026–2030 (Updated Weekly)

By Brent Richardson, Mortgage Broker & Certified Financial Planner (CFP®)

The decisions Canadians make on their mortgage in 2026 largely depend on the mortgage rate forecast. It’s a decision that will affect homeowners for several years to come and could save thousands of dollars in mortgage interest.

Here we’ll look at where mortgage rates are likely headed, based on a review of real time economic insights, and years of in-depth, ‘ground level’ mortgage market study, with over 1,900 mortgages personally closed.

You’ll learn how to position yourself for the best possible mortgage rate – and turn it into real savings over the next five years.

Page Last Updated: February 24, 2026

Key Takeaways:

- On January 28, the Bank of Canada held its overnight rate at 2.25%, which is the low end of the neutral range (2.25%-3.25%).

- The Next BoC meeting is on March 18, 2025, with a 93% chance of a hold.

- Core inflation for January was down 0.01% from the previous month, but remains sticky at 2.3%, keeping a floor on further BoC cuts.

- Uncertain US trade negotiations on one side and a stimulative $78.3B federal budget deficit and stabilizing jobs market on the other side, create a tug-of-war between weak growth (downward rate pressure) and inflation concerns (higher rate pressure).

- Financial Markets currently project relatively flat interest rates in 2026 and the majority of 2027, while most big banks (excluding Scotiabank and National Bank) expect the BoC to remain on pause in 2026. Check back weekly for the latest odds on rate hikes/cuts.

What’s New This Week

- CPI/Inflation in Canada crept down to 2.3%, however this was mainly due to lower gasoline prices. Excluding gas, inflation was 3%. Inflation is still at the upper end of the BoC preferred range and will not likely cut in this environment.

- Bond yields are down to ~2.73%; this puts downward pressure on fixed mortgage rates.

We’re watching: Canadian GDP reading out Feb 27

Fixed Mortgage Rate Pressure

2026 Interest Rate Canada Outlook: Market Odds

Bank of Canada interest rate forecast (based on Bond Yield and OIS market odds):

| Meeting Date | Decision Probability | If Change |

| March 18, 2026 | 93% Hold | 2.00 % if cut |

| June 10 | 80% Hold | 2.00 % if cut |

| December 9 | 68% Hold | 2.25 % if hike |

Bank of Canada Playbook

Pause for 2026. Markets currently price just a 5-7%% chance for a BoC overnight rate cut in all of 2026. Markets are also forecasting an 70% chance of a hike by year end 2027. This is based on all available political and economic data, but it may change as trade and other government policies affect the economy.

Big Bank Interest Rate Forecasts

| Bank | Year-End 2025 BoC Rate | Year-End 2026 Rate |

| RBC | 2.25 % | 2.25 % |

| TD | 2.25 % | 2.25 % |

| Scotiabank | 2.25 % | 2.50 % |

| BMO | 2.25 % | 2.25 % |

| CIBC | 2.25 % | 2.25 % |

Big Bank Consensus

Pause for 2026. With the exception of Scotiabank and National Bank, Canadian banks agree with market based forecasts that the Bank of Canada will hold for 2026. They note that inflation remains a greater threat than an existential trade shock from the USA, which puts upward pressure on interest rates. However, softness in employment and productivity growth will keep inflation and interest rates in check.

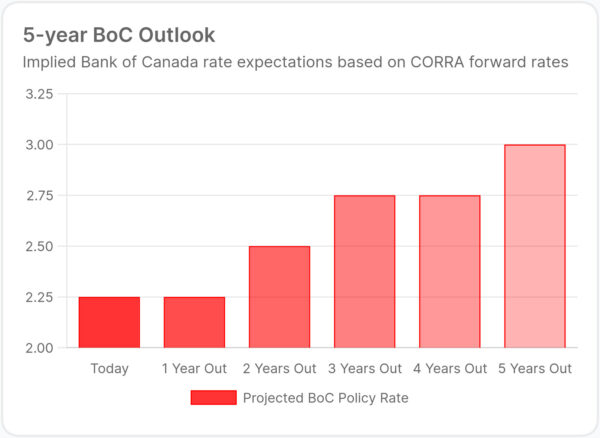

Medium-Term Mortgage Rate Forecast (2026–2030)

| Year | BoC Overnight Rate (Est.) | 5-Yr Fixed | Variable (P -0.75%) | |

| 2026 | 2.25% | 3.8 – 4.1% | 3.7 % | |

| 2027 | 2.25 – 2.25% | 4.0 – 4.4% | 3.7% | |

| 2028 | 2.25 – 2.50% | 4.5 % | 3.95% – 4.2% | |

| 2029 | 2.50 – 2.75% | 4.7% | 4.2% | |

| 2030 | 3% | 4.7% | 4.45% |

Overall, we project a gentle normalization of interest rates: higher than the ultra-low 2010s, but not restrictive. Expect mortgage rates to range from 4–5% as the new normal over the next 5 years.

Current Information Driving This Rate Forecast

Below is the most important economic information that is factored into these interest rate forecasts.

Taken together, the information forms an economic forecast that the Bank of Canada is likely to base its interest rate decision on, and also that is currently priced into bond yields/ fixed mortgage rates.

In other words, financial markets use this key economic information, primarily through bond pricing, to predict how the BoC will act in the months and years ahead.

The data are arranged from ‘highest level’ or broadest to most specific, generally reflecting the ‘flow’ of economic cause and effect, and how it’s ultimately distilled into Government of Canada bond yields and interest rate probability/odds.

Global Trade Developments

(Neutral Rate Pressure currently, but most likely to change) Canada has weathered US trade negotiations well so far compared to most other countries. Specifically, the CUSMA trade agreement has protected the vast majority of US-Canada trade from US tariffs.

However as CUSMA comes up for re negotiation starting in July 2026, there will likely be economic pressure on Canada to draw trade concessions in favour of the US. The extent to which these concessions are successful, or that Canada/US do not come to a trade agreement, will alter CUSMA accordingly.

We expect a bumpy and somewhat dramatic trade negotiation, and this in and of itself will likely impact the Canadian economy, However we also expect the end result heading into 2027 will not be catastrophic for Canada.

How Canada fares during and post negotiation will have an affect on fixed and variable mortgage rates, and we will continue to update on this key issue as it develops.

Federal Government Policy

(Upward Rate Pressure) Higher Government spending combined with large budget deficites have an upward pressure on inflation and bond yields/ fixed mortgage rates. More specifically, as Government spending flows through the economy, this adds upward pressure to prices of goods and therefore inflation. Also, as the Government issues more debt (Bonds is the main form of government debt), investors who buy these bonds are likely to demand a higher rate of return as risk increases, and investors demand higher incentive/compensation for this risk. Ultimately this is an upward long term pressure on fixed mortgage rates, regardless of decisions made by the Bank of Canada,

Economic Growth/ GDP:

(Neutral Rate Pressure) Real GDP contracted in December 2025. This results in flat Canadian real economic growth year to date, with early data for January also pointing towards economic flatness.

Employment:

(Neutral Pressure) Employment shows signs of stabilizing. In January Canada lost 25,000 jobs. On one hand 75,000 part time jobs were lost. Otn the other hand 50,00 full time jobs were gained. The market interpreted this as a sideways-to-slightly-negative employment reading.

Inflation:

(Upward Rate Pressure) Core inflation remains stubbornly close to 3%, despite falling fuel prices. Grocery costs, auto insurance, and cell phone prices are the main culprits. Until core inflation dips below 2%, expect limited BoC easing. Stabilizing employment may not lead to lower inflation in the short term, as the BoC and economists had been expecting.

BoC Policy statements:

To summarize current BoC communication as of their most recent press release:

- They are satisfied with the level of the overnight interest rate.

- The BoC is factoring in sustained softness in economic growth and employment, with rates at current levels.

- An economic or trade crisis would cause the BoC to reevaluate the current 2.25% rate (and likely cut it further). However, this is currently a ‘wait and see’ situation.

5 YR Government of Canada Bond Yield:

The 5 YR government of Canada bond yield is highly correlated and predictive of 5 year fixed mortgage rates. When we see this yield drop substantially, expect 5 year fixed rates to fall. But it’s the opposite when yields are rising – expect upward pressure on fixed mortgage rates.

Currently, the 5 year bond yield is seeing moderate upward pressure. Fixed mortgage rates are likely stable for now, but an additional upward move in the bond yield would likely push fixed mortgage rates higher.

However if the Canadian economy weakens in early 2026, we’ll see yields and fixed rates soften.

2 YR Government of Canada Bond Yield

The 2 year government of Canada bond yield is generally a good predictor for where the Bank of Canada overnight rate will be within 2 years.

The current 2 year yield of ~2.58% indicates upward pressure on the BoC overnight rate over the next 2 years. More specifically, according to this chart, we are likely to see a 0.25% increase in the BoC overnight rate from 2.25% to 2.5% within 2 years.

Fireside Rate Chat with Brent Richardson (Article Author, Mortgage Broker)

Short Commentary on Video:

“Inflation still runs hotter than markets expected, and that’s the bigger risk than a US trade slowdown. Unless we see a major global shock or a sharp rise in unemployment, rates are unlikely to fall much further. This is especially supported by recent strength in jobs numbers. It’s a time to manage risk, not chase the absolute lowest rate.”

How This Rate Forecast Applies to Your Mortgage

Let’s translate the mortgage rate forecast as seen above to how you can save on your mortgage, based on your situation.

Should You Take a Variable Mortgage Rate?

Variable rates have hit a near term bottom, based on current market data and Bank of Canada commentary that they are ‘satisfied with where rates are’.

More specifically, the BoC is counting on further economic softness in Canada and on inflation dropping from here. So further declines in these areas will not impact near term BoC decisions.

With that said, data can change quickly, and if there is a crisis, such as a longer term breakdown in trade relations with the US or a banking crisis, this could send BoC rates spiralling down and variable mortgage rates along with them to stimulate employment and the economy.

This kind of economic crisis is speculative and not substantially priced into the market data/bond yields.

Given this, selecting a variable mortgage rate with the expectation of further Bank of Canada cuts would be a ‘bet’ that the market is currently wrong, and that the economy is likely to face significantly harsher economic weakness.

This line of reasoning carries a higher level of risk. Its possible that this economic weakness happens, but less likely. So while the odds are lower for variable rate declines, you could also see more reward if it does happen.

For this reason, the variable rate is recommended only to those who have a higher risk tolerance and a stable household balance sheet.

Should You Take a Fixed Mortgage Rate?

Fixed mortgage rates have levelled off for now and are likely at their short- to medium-term bottom—again, barring some sort of significant economic disruption.

Inflation is currently a greater threat to pushing up interest rates than a trade or banking crisis is to bringing them down. In fact, financial markets are calling for rate increases in 2027 through 2029.

Based on this data and perspective, it may be prudent to consider a 5-year fixed rate term in the high 3% or low 4% range.

For thouse with a lower to balanced risk tolerance a 5 year fixed is likely the best decision based on these mortgage rate predictions.

For those with a balanced to higher tolerance for risk, a 3 year fixed is may be the best decision because the 3 year rate allows for more flexibility to break during the term and switch into a lower rate if rates drop (or on the renewal date in 3 years). However if rates are in fact higher in 3 years, this decision would result in higher interest costs and therefore is a riskier option than a 5 year fixed rate.

See Our Full Fixed Vs Variable Rate article HERE

Mortgage Renewals

Renewing your mortgage in 2026? Expect the most discounted fixed rate specials to be in the 3.79% – 4.1 % range, with variable rates in the 3.55 – 3.70% range.

Consider renewing early if you’re coming off a higher rate (ex. a 2-3 year fixed rate above 5%), and either has a relatively low 3 month interest breakage penalty, or NO penalty given close proximity to the renewal date.

If a lender offers a rate under 4%; the net savings over 5 years can realistically be $1,000 – $3,000 on a $500,000 mortgage.

Consider a rate hold of up to 4 months. Although the current lender won’t likely hold the rate, approach a mortgage broker such as Altrua Financial to protect your rate against upside while leaving the opportunity to reduce it if rates drop. There is no financial cost, and only a benefit to this renewal rate strategy.

Home Buyers

Affordability improves slightly as rates ease, but stress-test levels remain higher at 2% over the contract rate you’ve been quoted.

Given this, the variable rates in the 3.60% range will result in the highest pre approvals, with the stress test rate in the 5.6% range. However, not by much—likely just a few thousand in higher pre approval over a fixed rate in the 3.79%-3.99% range.

The most important factor in your home-buying mortgage rate is payment affordability relative to other goals. Here are some essential questions:

Will you have the flexibility to pursue other life interests and goals?

Do you plan on having your mortgage paid off before or by retirement?

Are you saving enough for retirement while also paying your mortgage?

Would an increase in the rate during the term affect these goals? Or is there sufficient cash flow in your household to withstand a payment increase?

Investors

For those with a higher risk tolerance, leveraged investing is attractive with a high 3/ low 4% borrowing cost.

Given forecasts of higher inflation, this may put upward pressure on equity and other asset markets.

At the same time, higher inflation is likely to push up rates in the medium- to long-term.

But for the time being, interest rates remain close to inflation—slightly higher, potentially a time to lock in for a longer period, such as 5 years—focusing on the delta of higher asset growth than a rate of ~4%.

On the other hand, a variable rate could act as a hedge against an economic crisis. If the economy were to plunge and take asset prices with it, at least your mortgage interest costs would fall too. Although this scenario isn’t priced into markets currently, it does not rule out consideration of this strategy.

How Interest Rates are Influencing Canada’s Housing Market

- Falling rates typically spark demand, but not in 2025 due to buyer hesitation from trade and general economic uncertainty.

- National prices are flat (+0.3 % y/y), while new listings have climbed 15%, improving buyer market conditions.

- Regional split: GTA and GVA remain soft, with slightly lower month-over-month values; the Prairies show resilience.

Expect continued softness into the winter of 2026, and when trade and economic prospects stabilize (even if at a slower growth rate) a steady, data-driven recovery, not a boom, driven by attracting mortgage rates and better affordability.

FAQ

Q: Will mortgage rates drop further in 2026?

A: Possible, but only if core inflation falls below 2.5 % and unemployment rises significantly (ie 9%+ nationally). Expect a move towards stability, not sharp declines – or increases.

Q: Will we see 2% mortgage rates again?

A: Highly unlikely. Canada’s neutral rate is 2.25 – 3.25 %, drawing the 5-year fixed in the 4 – 5 % range longer term.

Q: How do tariffs and trade tensions impact rates?

A: Tariffs add short-medium term global inflation.The effect is a gradual but persistent upward pressure on interest rates.

Q: What is the best strategy for 2025 borrowers?

A: For most, a 5-year fixed near (ideally under) 4% balances stability and cost. This is a good conservative play. While confident borrowers can start with a variable and monitor lock-in points

About Brent Richardson

Mortgage Broker | Founder Altrua Financial Inc | Certified Financial Planner (CFP)

Brent has helped thousands of Canadians optimize their mortgage and investment strategies. With over 1,900 mortgages closed and nearly two decades of experience at the intersection of mortgages and financial planning, Brent combines real-world data and insight for clients who want clarity in a changing market.