Best BMO Mortgage Rates in Ontario

*The rate below represents an estimate of the best BMO mortgage rates in Ontario currently. Mortgage applications and rates are subject to BMO review and discretion and your rate could be lower or higher depending on multiple approval factors. Rates are available on approved credit and are subject to change.*

| Term | Current Discounted BMO Mortgage Rate Estimate |

|---|---|

| 5 Year Fixed | 4.29% |

| 3 Year Fixed | 4.34% |

| 2 Year Fixed | 4.49% |

BMO Ontario Mortgage Rates: Fixed and Variable Rates

BMO

As of May 1, 2025

As of May 1, 2025

-

1 Year Fixed

7.34%

Payment: $18,94/mo

10-20/10-20 pre payment -

2 Year Fixed

6.99%

Payment: $18,94/mo

10-20/10-20 pre payment -

3 Year Fixed

4.44%

Payment: $18,94/mo

10-20/10-20 pre payment -

4 Year Fixed

6.34%

Payment: $18,94/mo

10-20/10-20 pre payment -

5 Year Fixed

4.24%

Payment: $18,94/mo

10-20/10-20 pre payment -

10 Year Fixed

7.19%

Payment: $18,94/mo

10-20/10-20 pre payment -

5 Year Variable

4.55%

Payment: $18,94/mo

10-20/10-20 pre payment

BMO Ontario Main Branches

| Location | Address | Phone Number |

|---|---|---|

| Kitchener | 345 King St W UNIT 101, Kitchener, ON N2G 0C5 | (519) 885-9200 |

| London | 270 Dundas St, London, ON N6A 1H3 | 905-526-2000 |

| Hamilton | 50 Bay St S, Hamilton, ON L8P 4V9 | (519) 667-6129 |

| Ottawa | 90 Elgin St #6, Ottawa, ON K1P 0C6 | (613) 564-6037 |

| Toronto | 100 King St W, Toronto, ON M5X 1A3 | (416) 867-5050 |

Specialty Mortgage Offers at BMO

BMO Smart Fixed Advantage Mortgage

The BMO Smart Fixed advantage mortgage offers borrowers the predictability of fixed mortgage payments, but at a discounted rate. The rate on the Fixed Advantage mortgage is actually deeper than their standard mortgage products. There may be limitations on this product, and these potential limitations should be considered along side the lower rate. But for many in Ontario, this can help to lower mortgage interest costs.

130 Day Rate Hold

Most major banks offer a standard 120 days to hold their lowest rates. However BMO offers 130 days which could be a significant benefit, especially in a rising interest rate market. Perhaps it takes longer to find the right home, or to close the home. These extra 10 days could make a noticeable difference.

BMO EcoSmart Mortgage

The BMO EcoSmart Mortgage is a forward-thinking mortgage product that rewards borrowers for purchasing or upgrading an energy efficient home. Examples of energy efficiency include an efficient heating/ cooling system, a well insulated attic, and well sealed windows and doors. The savings from these energy efficiencies will add to the benefits of this program.

BMO Readiline

The BMO Readiline combines the utility of a mortgage and the flexibility of a lower rate credit line. Borrowers may benefit from a host of BMO mortgage flexibilities, including the 130 day rate hold, pre payment features and portability features. But also have a credit line available for any purpose, including a rainy day fund. The HELOC portion of the mortgage floats with the Bank of Canada prime rate, whereas the fixed mortgage portion may have a static payment. There is no interest charged on the credit line unless there is a balance owing.

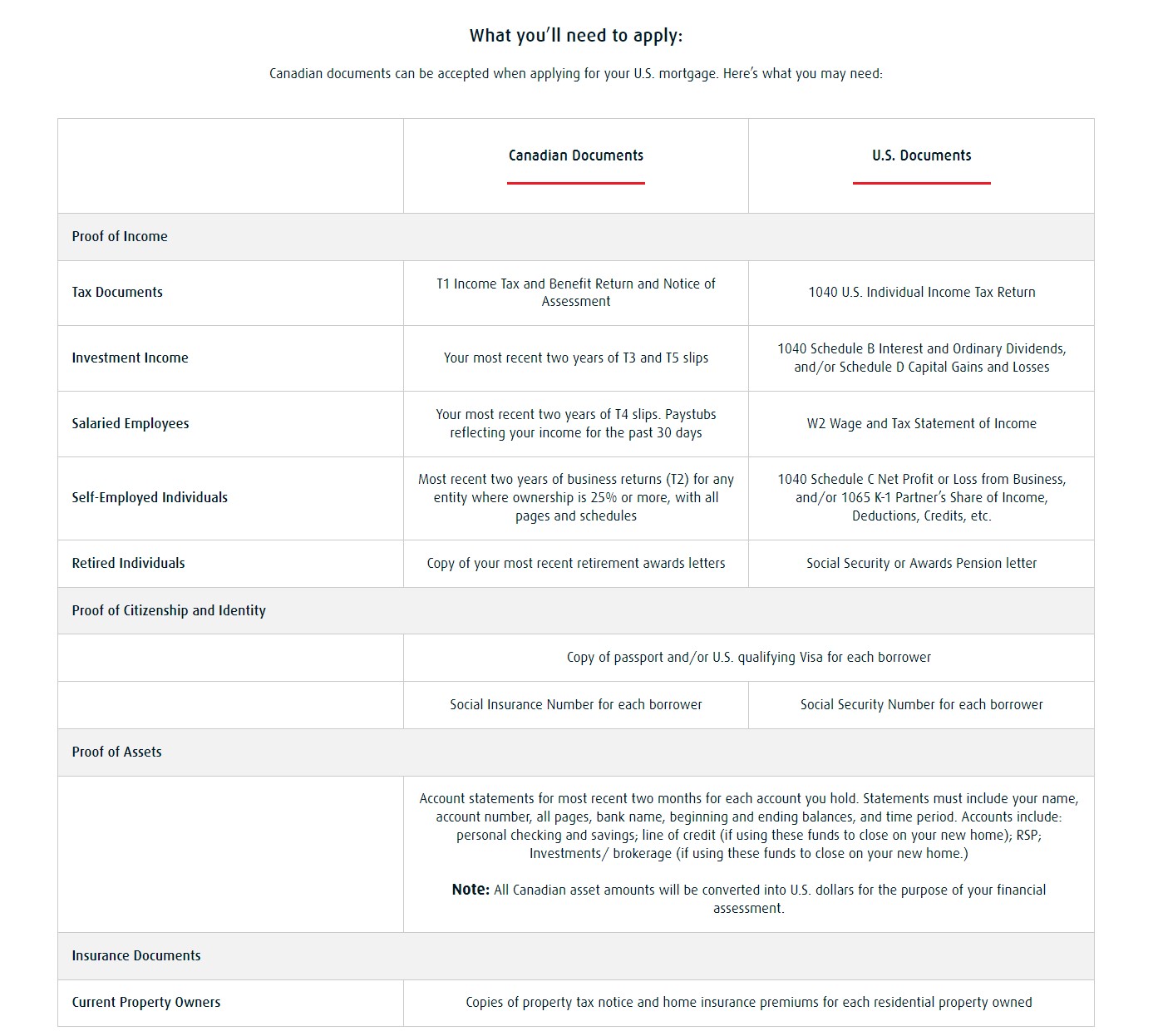

Cross-boarder Mortgage

Not all major banks have a program that allows lending in the USA. But BMO has one of the most competitive. For those looking to purchase in the USA, BMO may lend up to $2,000,000. See below for some of the documents that may be accepted depending on the country income is earned in and citizenship.

BMO Mortgage Pre-Approval Process

The BMO mortgage pre approval process is exceedingly straightforward – by design. Weather youre applying online or in person, you can expect the same type of thorough and reliable treatment including:

- Introduction meeting to determine goals, answer questions and quote rates.

- Based on your information a pre approval is generated.

- Once the house is found (if purchasing) or the appraisal is complete (refinance) the full mortgage approval proceeds.

- The mortgage approval is reviewed and signed.

- The mortgage closes with a legal service.

Types of Mortgages at BMO

Mortgage Renewal

Whether your mortgage is currently with BMO or you are considering transferring your mortgage to BMO, the mortgage renewal process is very efficient. BMO offers competitive rates that may be lower than your current banks rate, and has also been known from time to time, to offer a suite of cashback and banking incentives for switching. Either way, considering this leading Canadian bank for your transfer is always a good idea.

Mortgage Refinance

The mortgage refinance is similar to a regular mortgage renewal or ‘transfer’, except the mortgage can be changed more with a refinance. For example, a bigger mortgage can be applied for and used to pay out your existing mortgage, plus some extra amount for any need, such as debt consolidation or home updates. This is how an equity takeout mortgage works.

Moreover, with a refinance, the mortgage amortization can be extended to help lower payments when rates are higher or finances are tighter. Then, once rates drop and incomes increase, BMOs’ annual pre payments of 10% or more may be used to repay the mortgage principal faster.

Purchase Plus Improvements

When buying a home, especially in the resale market, there may be some updates desired to bring the property up to your standards and taste. The purchase plus improvement program is designed to add these upgrade costs directly into the mortgage. There are a few steps for this program to work, such as obtaining a quote for the improvement work before the mortgage is applied for. However, overall, the process is relatively straight forward and has been used by thousands of homeowners in Ontario to add value to their purchase.

Cottage Mortgages and Second Homes

The cottage mortgage program at BMO offers the same great rates on second properties, or very close to them, as they do on owner occupied properties. This can help make the dream of owning a cottage happen sooner. If you are looking to buy a home for children or parents, the same second home program applies. There are differences between cottage property types, however, so be sure to contact for more details.