BMO Mortgage Rates in Ontario & Lender Review

*Mortgage applications and rates are subject to BMO review and discretion and your rate could be lower or higher depending on multiple approval factors. Rates are available on approved credit and are subject to change.*

| Term | Current Discounted BMO Mortgage Rates |

|---|---|

| 5 Year Fixed | 4.19% |

| 3 Year Fixed | 4.09% |

| 2 Year Fixed | 4.29% |

BMO Ontario Mortgage Rates: Fixed and Variable Rates

BMO

As of January 8, 2026

As of January 8, 2026

-

1 Year Fixed

5.84%

Payment: $18,94/mo

10-20/10-20 pre payment -

2 Year Fixed

5.14%

Payment: $18,94/mo

10-20/10-20 pre payment -

3 Year Fixed

4.39%

Payment: $18,94/mo

10-20/10-20 pre payment -

4 Year Fixed

5.99%

Payment: $18,94/mo

10-20/10-20 pre payment -

5 Year Fixed

4.49%

Payment: $18,94/mo

10-20/10-20 pre payment -

10 Year Fixed

6.70%

Payment: $18,94/mo

10-20/10-20 pre payment -

5 Year Variable

4.15%

Payment: $18,94/mo

10-20/10-20 pre payment

BMO Ontario Main Branches

| Location | Address | Phone Number |

|---|---|---|

| Kitchener | 345 King St W UNIT 101, Kitchener, ON N2G 0C5 | (519) 885-9200 |

| London | 270 Dundas St, London, ON N6A 1H3 | 905-526-2000 |

| Hamilton | 50 Bay St S, Hamilton, ON L8P 4V9 | (519) 667-6129 |

| Ottawa | 90 Elgin St #6, Ottawa, ON K1P 0C6 | (613) 564-6037 |

| Toronto | 100 King St W, Toronto, ON M5X 1A3 | (416) 867-5050 |

BMO Mortgage Review (2026): Competitive with a Practical Edge

BMO isn’t usually the flashiest of the Big 5, but behind the scenes it’s one of the most borrower-friendly big banks in Canada. Between its longer rate holds, flexible Readiline product, and unique programs like the Smart Fixed Advantage and EcoSmart Mortgage, BMO has carved out a niche for clients who want predictable payments — with a touch of innovation.

Here’s an inside look at how BMO stacks up for Ontario borrowers in 2026, what it does well, what to watch out for, and who it fits best.

Unique BMO Mortgage Programs

BMO Smart Fixed Advantage Mortgage

The Smart Fixed Advantage is BMO’s value play — a discounted fixed-rate mortgage that undercuts its standard posted rates. You still get the peace of mind of a fixed payment, but at a sharper price.

Why it matters: For borrowers who prioritize rate stability but want to avoid paying Big Bank premiums, this program offers meaningful savings.

Watch out for: There may be restrictions — like reduced portability or limited prepayment privileges — so always read the fine print before choosing the “Advantage” version.

130-Day Rate Hold

Most lenders cap rate holds at 120 days. BMO quietly goes one better with a 130-day hold. That extra week and a half can be gold in a rising-rate market or if your purchase closing date drags out.

It’s a small edge — but sometimes small edges save thousands.

BMO EcoSmart Mortgage

This forward-looking program rewards borrowers for buying or upgrading energy-efficient homes. Qualifying improvements include efficient HVAC systems, high-performance windows, or added insulation.

Bottom line: It’s a rare case where being greener genuinely pays — lower energy bills plus a small rate discount from the bank.

BMO Readiline

The Readiline is BMO’s hybrid product — part fixed or variable mortgage, part HELOC. It combines the discipline of fixed payments with the flexibility of a credit line for renovations, investments, or emergencies.

- The mortgage side can be fixed or variable.

- The credit-line portion floats with BMO Prime, and you only pay interest when you borrow.

Pros: A clean, integrated structure with portability and prepayment options.

Cons: Like other collateral-registered plans, switching lenders later can be cumbersome and more expensive.

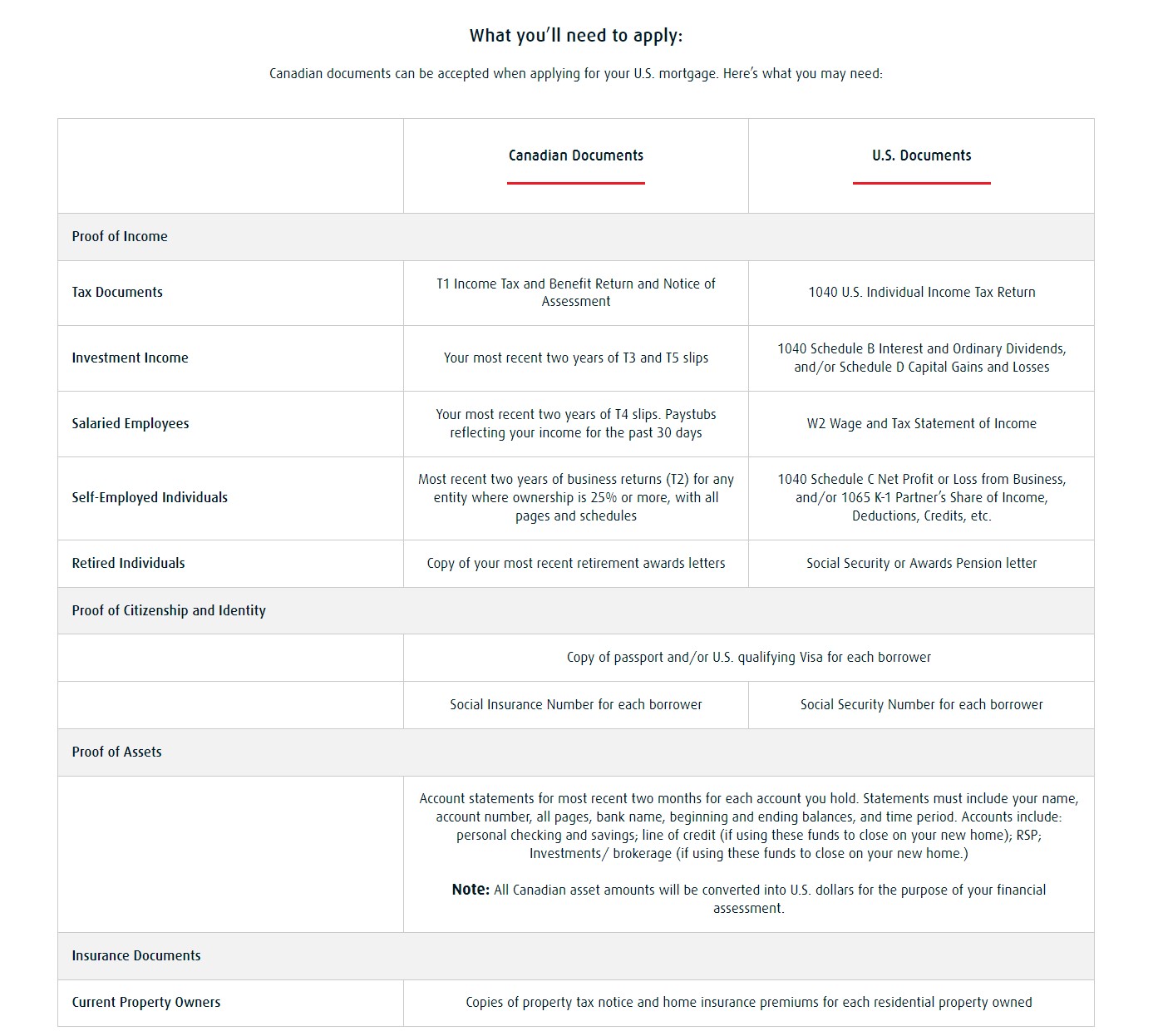

Cross-Border Mortgage

BMO is one of the few Canadian banks with a dedicated U.S. lending arm, offering mortgages for Canadians buying property south of the border — up to USD $2 million.

Perk: Streamlined process using your Canadian credit history.

Caveat: Documentation and approval standards differ depending on your income source and citizenship status.

Types of BMO Mortgages

Purchase

BMO provides a straightforward approval process — online or through a specialist. You’ll go through a simple five-step journey: consultation, pre-approval, property selection, full approval, and closing.

It’s predictable, efficient, and backed by one of Canada’s most established lenders.

Mortgage Renewal

Renewing with BMO is typically smooth. Whether staying with the bank or transferring from another lender, BMO often pairs competitive renewal rates with cash-back or fee-coverage incentives for switches.

Tip: Always compare against broker-sourced rates before you sign the renewal — BMO’s first offer usually leaves a little room for negotiation.

Mortgage Refinance

Need to access equity? BMO allows refinances for debt consolidation, renovations, or investment, often with the option to extend amortization to lower payments.

You can also take advantage of 10%+ annual prepayments once cash flow improves — a practical way to speed up repayment later.

Purchase Plus Improvements

For buyers eyeing older homes needing updates, BMO offers a Purchase Plus Improvements program. You can roll renovation costs directly into your mortgage, provided quotes are supplied upfront.

It’s an efficient route for first-time or move-up buyers who want to upgrade right away without separate financing.

Cottage and Second-Home Mortgages

BMO applies nearly the same sharp rates to cottages and second homes as it does for primary residences — which can be a big differentiator. Whether it’s a family cottage or helping kids into their first home, BMO’s second-home program is flexible and competitively priced.

BMO Mortgage Pros and Cons

| Pros | Cons |

|---|---|

| Smart Fixed Advantage rates often undercut other big banks | Some products have more restrictive features |

| 130-day rate hold (industry-leading) | Collateral charge on Readiline can complicate switching |

| EcoSmart program rewards energy efficiency | Broker-channel rates sometimes lower elsewhere |

| Readiline offers true mortgage + HELOC flexibility | Prepayment limits smaller on discounted products |

| Strong incentives for switch and renewal clients | Limited branch expertise on niche programs (physician, net-worth) |

Bottom Line: BMO Mortgages in 2026

BMO tends to fly under the radar — but for many borrowers, it’s the quiet achiever among Canada’s major lenders. Its Smart Fixed Advantage and Readiline products give practical flexibility, while the EcoSmart option adds a modern, sustainability-minded twist.

You won’t find the most aggressive broker-only rates here, but you will find longer rate protection, solid service, and a broad product lineup that covers everyone from first-time buyers to cottage owners and cross-border shoppers.

Think of BMO as the reliable all-rounder — not the flashiest bank in the lineup, but one that delivers steady value for the right borrower.

Verdict:

Best for: Borrowers wanting rate stability with flexibility, eco-conscious homeowners, and those valuing long rate holds.

Not ideal for: Ultra-rate-sensitive borrowers or anyone who plans to switch lenders frequently.