An updated framework for analyzing and estimating mortgage rate trends

In a surprise move, the Bank of Canada (BoC) increased their overnight or prime rate from 4.50% to 4.75%. Here we will look at why this happened and what to expect over the next 6 – 12 months for mortgage rates. In summary, we will see that:

- There is still too much economic strength, causing a resurgence in inflation.

- An expectation of lower interest rates within 2023 and greater optimism about the economy helped fuel spending and sustained inflation.

- At the same time, we are seeing significant economic weakness and deterioration caused by the previous 4.25% of rate hikes.

- Now that the psychological effect or ‘optimistic expectations’ are compromised, it’s likely we’ll see a more cautious consumer, an economic slowdown, and lower inflation.

- Expectations/ confidence is the foundation of the economy. So the irony is: An expectation for lower interest rates promoted higher rates. An expectation for higher rates will promote lower rates.

We will apply this framework to position your mortgage for the most savings during this economic cycle.

The Canadian economy and inflation are still too strong

The surprise increase in inflation boils down to one central point: Inflation is still too high.

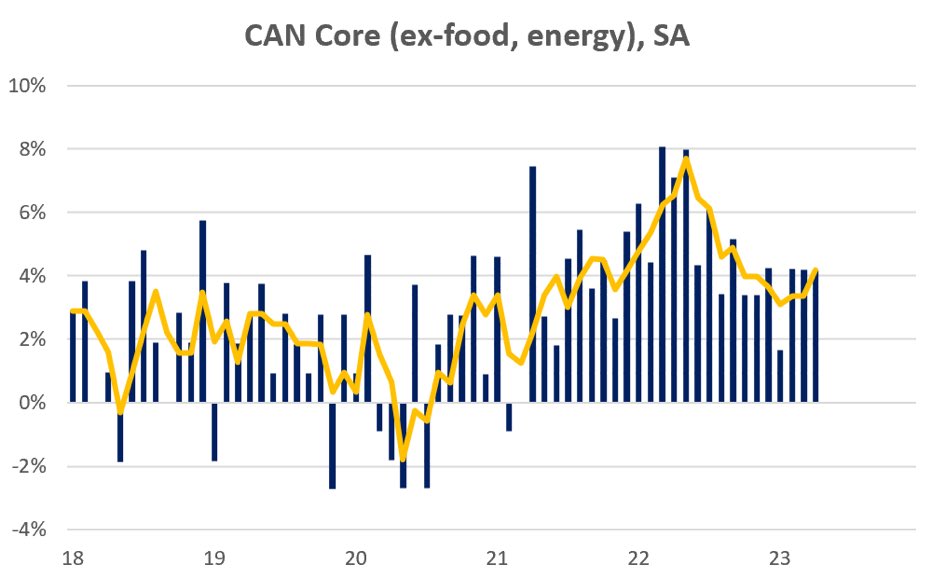

Inflation has been levelling off at approximately 5%, and the Bank of Canada (BoC) mandate is for 2% inflation. The primary inflation measure that the BoC looks at is called ‘Core Inflation’. This measure of inflation strips out food costs and energy/gas prices because these costs are more volatile and can too easily and quickly skew the rest of costs/ pricing in the economy.

The chart below shows how core inflation is levelling off over the past two months:

This trend is likely to continue or accelerate into June based on early data.

What’s causing this increase in inflation? A few things, all related:

Federal government stimulus:

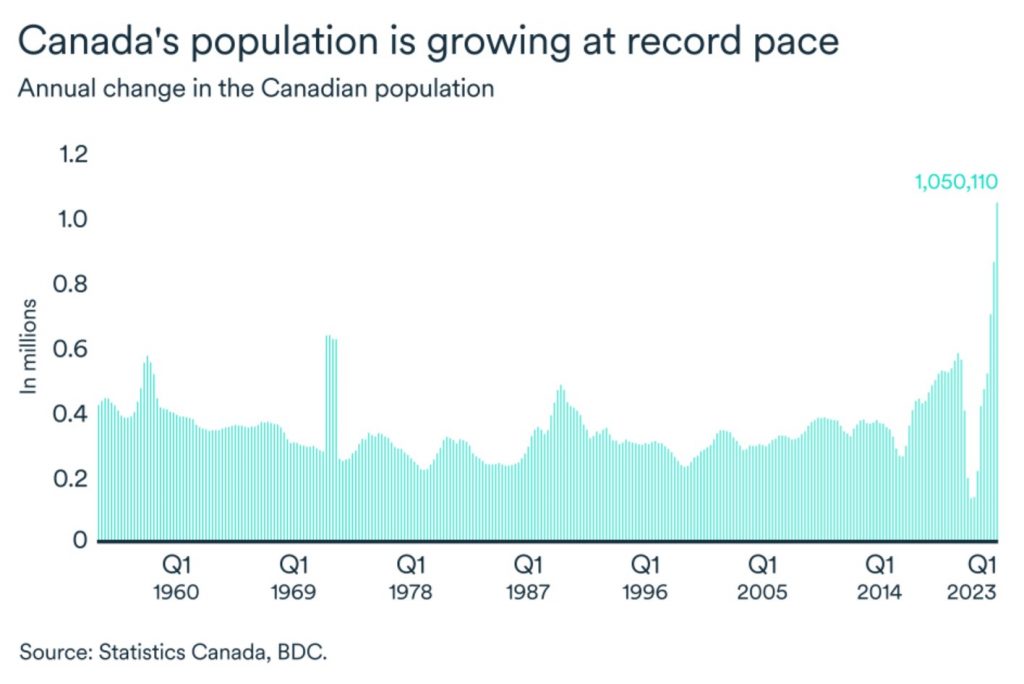

Canada is a land of immigration and long term, immigration is a key to the Canadian growth and development story.

At this time, Canada sees record immigration numbers:

- In 2022: 437,180 permanent, 607,782 non-permanent = 1,044,962 total (RECORD)

- In 2023: As of June, over 550,000 permanent and non permanent residence (non permanent not included in Federal statistics yet).

The current Federal mandate to maximize immigration is clearly stimulating the economy. It leads to more spending, greater employment, and more growth.

The issue is not with immigration itself; it’s that, at this point, the Canadian economy can’t sustainably accommodate more spending or growth without causing inflation. There are not enough goods and services to go around to the existing population, so as the population increases, the prices consumers are willing to pay increase or are ‘inflated.’

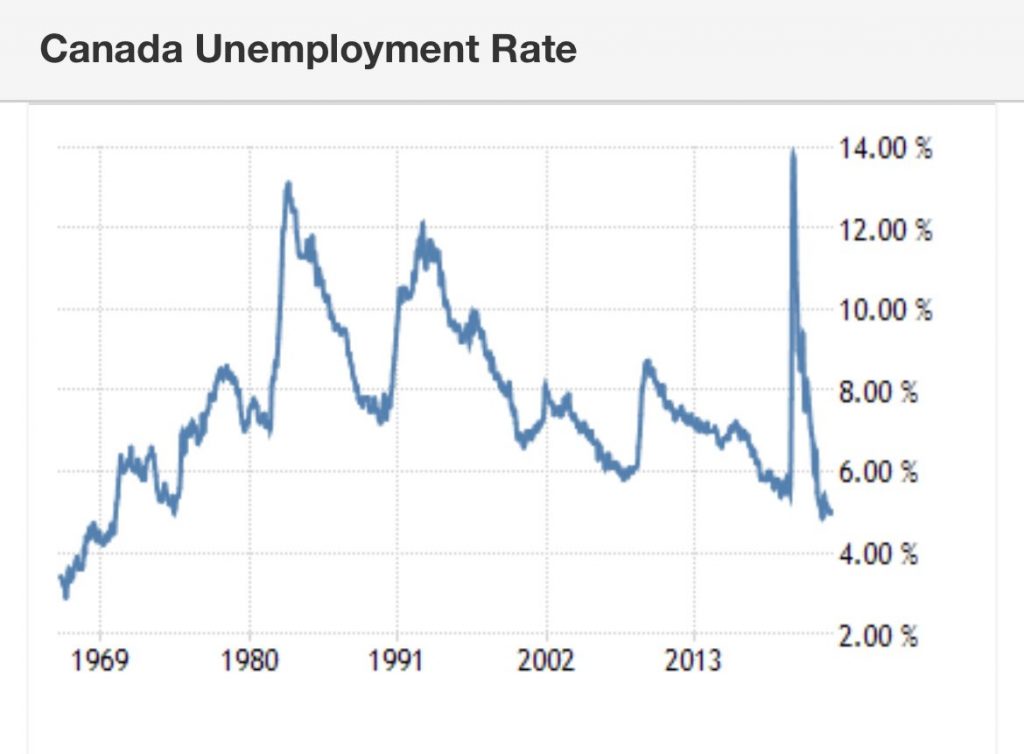

Employment is too strong currently and is creating a ‘wage-price’ spiral

Looking at the jobs market, it’s far too tight at the moment. Long term, a low unemployment rate is a worthy and important goal. How could any sane, reasonable person argue that fewer jobs are a good thing?

The problem is the current economy is creating more jobs than it can produce goods and services for. The system is out of balance, and to restore balance, either more goods and services must be produced at lower prices, or there needs to be lower employment to help reduce spending.

One problem with producing more goods and services is that much of this is done overseas, and it’s not so easy to turn on the taps without increasing price pressure.

Workers producing goods and services domestically in Canada demand higher wages – therefore, the cost to produce goods and services in Canada is increasing, which is very inflationary. When the cost of goods and services is higher, then, to keep up with inflation, even more wage increases are demanded, and the cost of producing goods and services increases even more.

So we see a ‘wage-price spiral’ form when there is an overheated job market with employment that’s too low for an economy to handle, and buying goods from overseas is a longer-term fix.

So the easiest way to balance the current inflationary wage-price spiral is to slow the economy through rate hikes. Less spending and corporate investment and more unemployment cause less upward pressure on wages and the cost of goods and services. In other words, the wage-price spiral must be broken through higher rates to create a more balanced and sustainable job market long term.

Another possibility is that high levels of immigration reduce wages, because new immigrants are often willing to work for less. This can be disinflationary. However, this disinflationary effect can be mitigated by higher demand for goods and services with a higher population – it’s difficult to tell currently which force is exuding more strength currently, as there is no concrete data source for this, but from what we are seeing, it’s likely the former exerting more force. Also for many immigrants to remain in Canada, they will rightfully demand a regular, respectful wage longer term.

Fewer jobs now, or lower paying jobs, will lead to substantially more well-paying jobs over the long term.

Bill C-47

Passed by the Liberal-NDP coalition, provides an additional $20 Billion to Canadians to help with daily life such as rent and grocery subsidies. Known as ‘helocoptor money’ in economics, because it is money that seemingly comes from above and enters into the economy. This is extremely inflationary and will likely have the opposite effect of the intention. Providing more money for rent, for example, can push rents/housing costs higher. The same goes for groceries and food inflation.

While the BoC is trying to suck money out of the economy to balance it, the Federal government is injecting money into it. A kind of ‘tug of war’ competition is happening between these two sides, with millions of Canadians stuck in the middle.

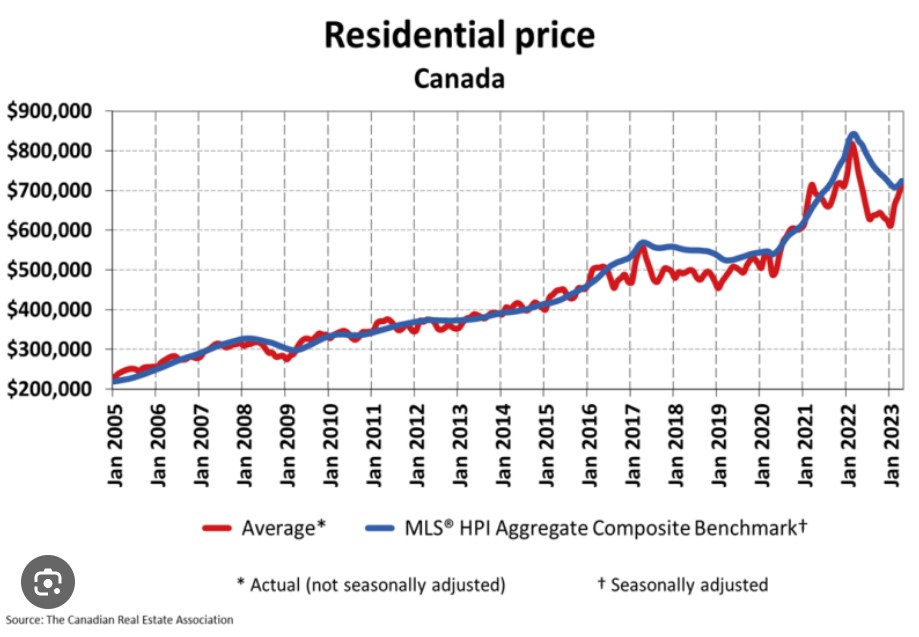

Housing market increase

The housing market in Canada is one of the most dynamic in the world. On the one hand, there is population growth and wage growth. On the other hand, housing is not being built fast enough. There is a major supply shortage. This should create a floor in pricing.

But as opposed to seeing a balanced housing market as rates increased into the stratosphere, we have been seeing in the first half of 2023 a major resurgence in the housing market with pricing up over 10% in major markets across Canada. This highlights the resiliency of the market.

The real issue is not higher housing prices in and of itself but that higher housing prices alongside higher interest rates are extremely inflationary. It can be inflationary whenever the consumer is willing to pay a higher price for something with a limited supply. Housing is by far the biggest area of expense, the Consumer Price Index and Canadian GDP. So the rate at which Canadians have been willing to pay over double the interest on rapidly increasing housing prices, which are getting closer to their former COVID-fueled, peak is a massive stimulus to inflation.

As we drill down further into why there has been more inflation, one point comes out over and above the rest: The psychological factor.

Consumer sentiment or expectation, or what we will refer to as ‘psychology’ here, is considered the foundation of 20th-century economics.

Fundamental to a strong and growing economy are expectations for the future. When expectations are optimistic, this fuels demand. When expectations are gloomy, people pull back on spending, save more, and wait for more optimistic times.

Post covid, the psychology around spending was launched on a springboard. As lockdowns ended a spending spree ensured. Some terms that have dominated the economic landscape over the past year have been You Only Live Once (YOLO) and Fear of Missing Out (FOMO). Although there is some reasonable logic to these ways of thinking/ spending, they have proven self-perpetuating to the point where the spending is irrational and unsustainable.

Spending more now, going further into debt, and not saving for future goals or slower periods is not sustainable.

Buying something now based on the fear that prices will be out of reach is a self fulfilling prophecy until prices have reached a bubble point, which is not sustainable.

When interest rates are expected to drop sooner, it’s easy to perpetuate this unsustainable thinking. To think, ‘this high rate environment is very temporary and if I dont get in now, I will miss out in 3 months when rates fall’, is inflationary. Or,’ I’ll spend now because the future income and situation will be that much better’ is inflationary.

The psychological effect of the recent rate increase

If the expectation for lower rates is lowered and the prospect of lower housing prices and less affordability is greater, this will have a major effect on the market.

Those who have been hanging on to a negative cash flow rental portfolio or to a home that was not easy to afford while rates were low are more likely to bow out.

Foreclosures, unfortunately, are likely to increase.

First time buyers on the sidelines who were starting to make offers may move back onto the sidelines.

As overall expectations for the economy become less optimistic, spending slows, unemployment trends higher, immigration decisions may change, and the economy and housing market slows. Inflation then drops.

Economic weakness will become more pronounced as the optimism falls.

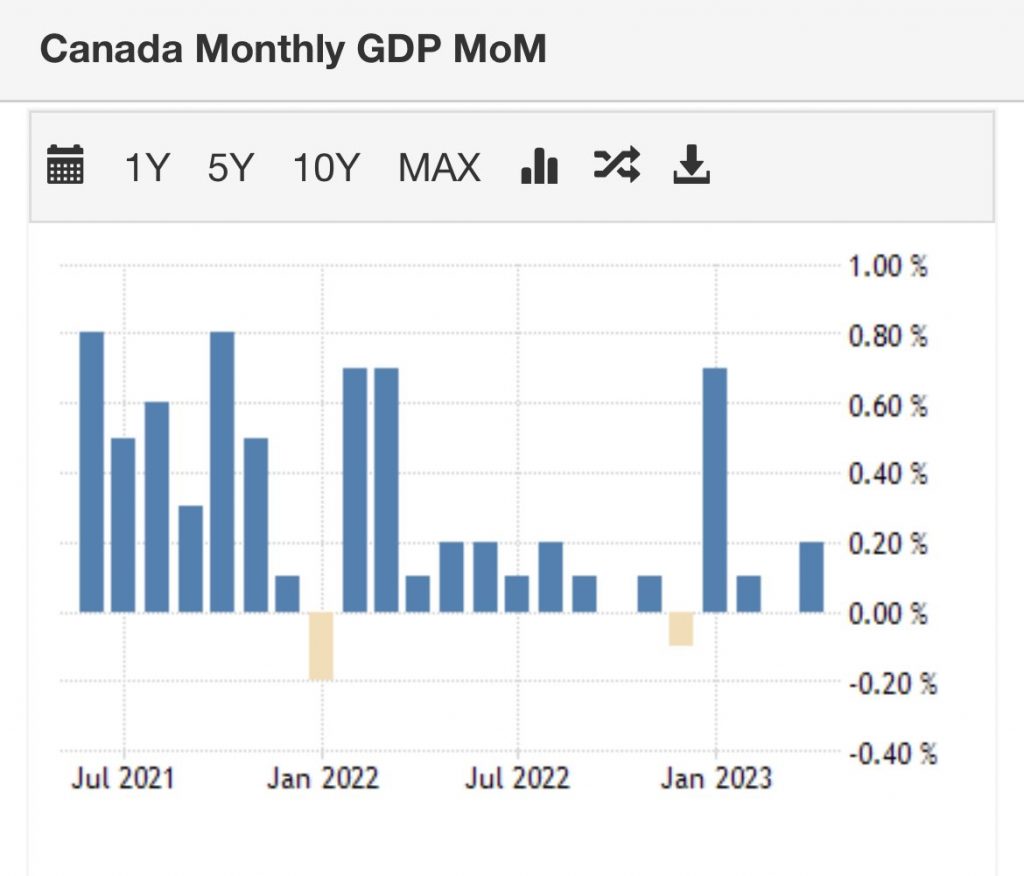

Over the past year and a half, as the BoC increased rates, there have been cracks forming in the economy

We are seeing:

- A major drop in temporary or seasonal works, to recessionary levels.

- More reliance on credit/ debt for spending.

- Credit delinquency/ missed payments surged over 18% from last year

- Much higher mortgage payments on renewals, or as variable rate payments are prompted higher.

- Increased loss provisions at Banks and Credit tightening.

- Commodity and shipping prices have returned to a normal, non inflationary range.

- Early signs of a weakening job market.

- A less optimistic settlement seen by new immigrants, at least near term, and possible decisions to move based on this.

As consumer psychology becomes less optimistic about the economy’s future and spending slows, these weaknesses will likely become more evident. These economic weaknesses promote disinflation/ lower inflation or even deflation (lowering the cost of goods and services).

One of the main economic themes in economics and this article is a ‘momentum building,’ or perpetuation of an existing trend.

As the underlying inflationary trends lose momentum and disinflationary trends gain momentum, we have an enhanced situation where an overarching disinflationary trend could break out.

The BoC seems determined to ensure inflation drops, no matter what simulating pressure it faces. Given this, it’s not a matter of if but when this situation plays out. It may not be in one or two months, but over the next year, we will likely see a trend that at least resembles this.

As this happens, a major economic slowdown or recession will likely occur. While the job market could prove to be resilient enough to soften the impact of a recession:

(1) The psychological effects weakened optimism, and (2) the negative impact on personal/corporate budgets caused higher rates causing lower spending align with each other.

Once this alignment occurs, we can expect bond yields to fall and fixed mortgage rates to drop.

Fixed mortgage rates, pegged to Government of Canada bond yield movements, will likely drop 3-6 months before the BoC drops its rate. Often up to a year, we can see bond yields and fixed rates move lower in anticipation of a BoC drop. However, the Bond traders will want to see more absolute evidence of an imminent economic contraction in this economy. Given this, we will likely see fixed rates drop a bit closer to the first BoC drop.

If the first BoC drop happens in the second half of 2024, we may start to see bond yields and fixed rates drop in late 2023 or early 2024.

Whereas 2-3 months may not be enough time for consumer psychology to align with the real pocketbook-eroding effects of higher rates, we could see stronger manifestation towards the end of 2023. 6 months is enough time to see a lot of change and for new trends to form.

If the psychology and economy are more resilient, then more rate hikes will be needed.If 0.25% – 0.50% of rate hikes to not phase the consumer sufficiently, we could easily see 0.75% – 1% of more hikes.

Consumer psychology and behaviour are in the driver’s seat, and the BoC will respond to how well the consumer keeps the economy on the road. The BoC does not keep the economy running faster or slower; the consumer ultimately does.

Now that consumer expectations and less optimistic psychology align better with the more literal, economically deteriorating effects of higher rates, we have a real shot of lower fixed rates in the next 6-12 months.

However, if the psychology/ economy/ inflation completx shows even more extreme resilience than now, it will take a bit longer.

The BoC will continue to increase rates until inflation is reduced to the 2% range.

From this perspective,it becomes a question of: ‘how much BoC increasing will it take to lower spending and inflation’?

This question can form a framework to estimate/project mortgage rates.

A few points to consider:

- Likely, the BoC will not want to drag on inflation for many years.

- BoC will continue its current rate hiking mandate until lower inflation has been achieved.

- The market cant withstand the prospect of another 1% increase in rates over the next 6-12 months.

- Noting the determination of the BoC, market psychology will capitulate sooner than later and expose the underlying economic weakness.

- If this ‘market capitulation’ happens within 6 months, we see a BoC rate peak.

- In this case, we are projecting lower BoC rates and variable-rate mortgages in the next 12 months. With lower fixed-rate mortgages in about 6 months.

The higher BoC rates go, the more severe the underlying economic deterioration, the sharper and faster the rate drop.

With this type of framework or a similar framework in mind, it’s best to follow the data one month or even one week at a time.

Applying this framework to mortgage rate recommendations:

With 1,2 and 3 year fixed mortgage rates closer in pricing as of June, it may be prudent to consider a 2 year fixed mortgage term.

Or if a slightly lower rate and more time buffer are desired to help weather this economic storm, then a 3 year may be more comfortable.

The right mortgage decision will be the one you feel best with. Consult with a licensed mortgage professional.

Click below for more information: