2 Year Fixed Mortgage Rates Ontario

Here we review the pros and cons of the 2 year fixed mortgage rates Ontario, and compare 20+ of the best 2 year rates.

2-Year Fixed Mortgage Rates Pros

- Will mature/renew in 2 years when there is a reasonable interest rate forecast that mortgage rates will be lower.

- Preformed well in our mortgage rate simulations (below) vs other mortgage rates such as a 5 or 4 year fixed rate.

- Offers additional time for inflation and mortgage interest rates to drop vs. a 1 year fixed or variable rate strategy.

Two Year Fixed Mortgage Rates Cons

- The rate is notably higher than a 3 year fixed rate, and especially a 5 year fixed rate.

- There is a potential for rates to remain higher for longer, that even in 2 years inflation and rates may not have dropped much lower.

- Conversely, mortgage rates could drop much sooner than 2 years and there would be higher interest paid than a variable rate or 1 year fixed rate.

Current 2 Year Fixed Mortgage Rates Ontario

Private: Template 2 Year Fixed

As of April 5, 2024

As of April 5, 2024

2 yr Fixed

Insured mortgage rates are typically for less than 20% down payment and are insured against default through the CMHC or comparable default insurer. This involves a one time insurance premium built into the mortgage principal. Maximums: 25 YR amortization, $999,999 purchase price. No refinances.

Insurable mortgages follow similar criteria as insured mortgages, but because these are 20%+ down payment/equity, there is no default insurance premium or additional cost built into the mortgage. Available for purchase and renewal, but not refinance/ equity takeout.

Uninsured mortgages are available for purchases of $1,000,000+ and refinance/equity take out transactions. Additional flexibility of uninsured mortgages includes optional 30 year amortization and more flexible borrowing limits.

-

Altrua scans its database of 100+ for the best rates, then negotiates these rates even lower!

Altrua scans its database of 100+ for the best rates, then negotiates these rates even lower!Altrua Financial Mortgage Rates

5.99%

25 YR AM max.Payment: $18,94/mo

6.19%

25 YR AM max.Payment: $18,94/mo

6.49%

Payment: $18,94/mo

-

TD

6.37%

Payment: $18,94/mo

6.47%

Payment: $18,94/mo

6.47%

Payment: $18,94/mo

-

BMO

7.64%

Payment: $18,94/mo

-

Payment: -

7.64%

Payment: $18,94/mo

-

CIBC

6.39%

Payment: $18,94/mo

-

Payment: -

6.39%

Payment: $18,94/mo

-

RBC

6.39%

Payment: $18,94/mo

-

Payment: -

6.49%

Payment: $18,94/mo

-

Scotia

5.94%

Payment: $18,94/mo

-

Payment: -

6.34%

Payment: $18,94/mo

-

National Bank

6.39%

Payment: $18,94/mo

-

Payment: -

6.39%

Payment: $18,94/mo

-

Manulife

-

Payment: -

-

Payment: -

-

Payment: -

-

Desjardins

6.79%

Payment: $18,94/mo

6.79%

Payment: $18,94/mo

6.79%

Payment: $18,94/mo

-

Laurentian Bank

6.19%

Payment: $18,94/mo

6.69%

Payment: $18,94/mo

6.69%

Payment: $18,94/mo

-

First Ontario

7.14%

Payment: $18,94/mo

7.14%

Payment: $18,94/mo

7.19%

Payment: $18,94/mo

-

Alterna

7.04%

Payment: $18,94/mo

7.04%

Payment: $18,94/mo

7.04%

Payment: $18,94/mo

-

DUCA

6.69%

Payment: $18,94/mo

7.04%

Payment: $18,94/mo

7.44%

Payment: $18,94/mo

-

MCAP

7.04%

Payment: $18,94/mo

7.04%

Payment: $18,94/mo

7.04%

Payment: $18,94/mo

-

First National

6.42%

Payment: $18,94/mo

6.42%

Payment: $18,94/mo

6.42%

Payment: $18,94/mo

-

ICICI

8.29%

Payment: $18,94/mo

8.29%

Payment: $18,94/mo

8.29%

Payment: $18,94/mo

-

CMLS

-

Payment: -

-

Payment: -

-

Payment: -

Two Year Fixed Rate Compared to Other Mortgage Rates

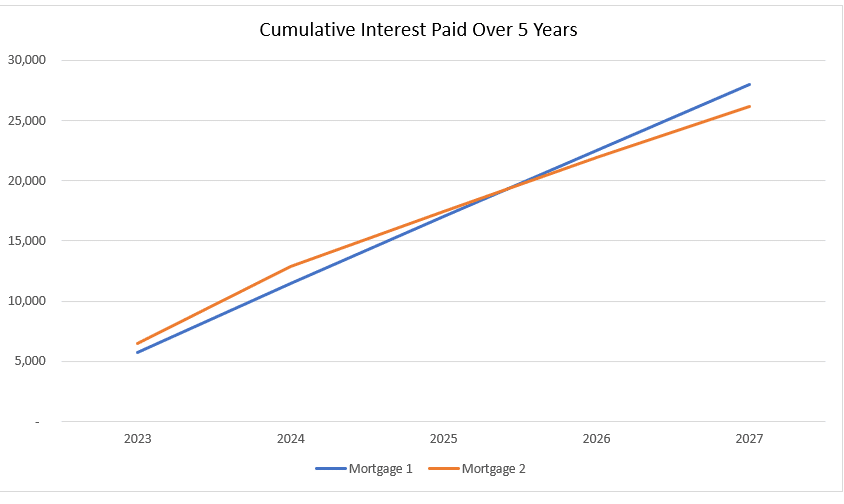

In our simulations of the two year fixed rate vs the 5 year fixed rate, the 2 year fixed compares up very well to the 5 year fixed rate and 1 year fixed rate.

The savings in our main ‘market consensus’ simulation was $2094 for every $100,000 of mortgage, over 5 years. This assumes a 5 year fixed rate of 5.79% compared to a 2 year fixed rate at 6.49%, but renewing after 2 years into a 4.75% rate.

In a similar comparison of the 1 year rate, there was $2158 of savings. This is given a 1 year fixed rate of 7.2% renewing in 1 year at 5%. However there is more risk associated with this projection/ scenario incase inflation and mortgage rates remain higher for longer.

Is a two year fixed mortgage rate enough time to allow mortgage rates to drop?

The short answer is that two years is likely enough time to see some drop in mortgage rates, but it is not guaranteed. When we hear the Central Bank of Canada saying higher for longer, and that mortgage rates in general will remain higher for longer, that is coming off the back of an expectation that rates would start falling in early-mid 2024. This was not the case, but the likelihood of mortgage rates dropping in 2025 or 2026 (depending on when you lock in) is far better.

In fact, most economists and the market are pricing Central Bank rate drops in mid to late 2024. This makes sense, given the economic slowdown momentum currently building with already high rates. There is substantial deterioration building in 2024, and as of October 2023 the market is still expecting almost another year of higher level before they start falling.

This seems like a reasonable amount of time for rates to start falling, and in fact, rates could begin falling sooner. Given this rationale, a two-year fixed rate could be the perfect rate to help you renew at a lower rate when rates have fallen substantially.

Will fixed rates start falling sooner than variable rate mortgages?

The short answer is yes. Approximately six months before variable rates start falling alongside the central bank rate crops, fixed rates, priced using Government of Canada bond yields, typically begin to fall because fixed rates fall sooner than variable rates. This bodes well for a two-year term.

Is there any risk of a two year fixed rate?

With any decision, there can be trade-offs. In the case of the two year fixed rate, the rate is higher than a five year fixed rate. So if rates did stay higher for longer, or for example, rates dropped and then went back up just in time for the two-year renewal. Then, you would have paid a higher rate, possibly for no reason.

This kind of situation runs counter to the market consensus. However, there is a chance that it could happen, and this is the main risk of a two-year fixed rate.